However, they soon realize that there are so many different investment options yet they have no time to research and compare. Stock prices are different every second . Is it impossible to create passive income while working? Fret not, we’ve devised the following three investment methods that can help you!

- *The Federation of Hong Kong and Kowloon Labour Unions

1. Time Deposits - Low Risk, Low Returns

If you are looking for low-risk investments, time deposits could be an option for you. It is a relatively conservative investment option but it guarantees stability.

The risk is lower than investing in stock markets, though you cannot withdraw your funds for an agreed period of time. The Hong Kong Deposit Protection also makes sure your funds are protected – so even if the market crashes and the banks go bankrupt, you will get compensated up to HKD500,000.

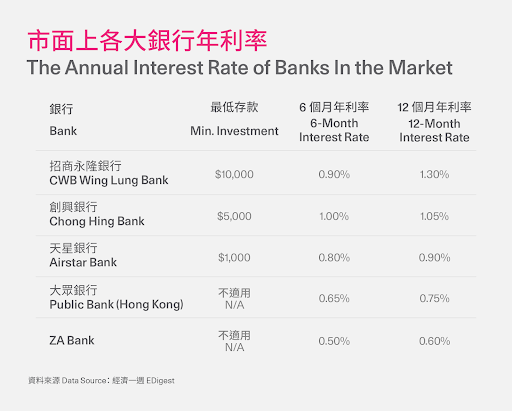

For instance, if you deposit HKD100,000 for a fixed term of 12 months, there is generally a 0.05% to 1.30% annual interest rate.

The annual interest rate of banks in the market

Among all the offers above, CMB Wing Lung Bank by far has the highest annual interest rate of 1.30%. When you save HKD100,000 for a year, you will get HKD1,300 interest. However, is that enough to beat inflation?

- *Data source: EDigest

2. Exchange Trade Funds (ETFs) - Long Term Investment Indexes

For those who don’t have time to follow the stock market fluctuations and trends, investing in ETFs is definitely a great alternative. Generally speaking, ETFs are divided into “passive” and “active”. Passive ETFs are designed to track specific themes. For example, the Heng Seng Index tracks Hong Kong’s big market leaders, or we can look at specific industry indexes (such as new economy stocks, technology stocks), or even specific asset classes (such as gold ETFs, bond ETFs). Active ETFs conversely do not track the index, but are managed by a fund manager who chooses the assets to invest in. Bottom line, purchasing one lot of an ETF is equivalent to buying into multiple companies and assets.

Take the Vanguard S&P 500 ETF (VOO) as an example. The growth rate has reached 73.92%* in the past five years. If you invest $100,000 HKD to buy VOO five years ago, the current price is already worth $173,920. Therefore, investing in ETFs not only diversifies risks, but more importantly, you no longer need to keep an eye on market conditions all the time. You have reached the objective of having passive income while focusing on your full time job.

Vanguard 500 index Fund (VOO) growth rate reached 73.92% in the past 5 years

- *Data source: Yahoo Finance

Not sure how to start investing in a global asset allocation? AQUMON is here to help! AQUMON’s robo-advisor personalizes an investment portfolio to provide optimal risk-adjusted returns that suit your preferences. Our star products SmartGlobal (a portfolio consisting of HK-listed ETFs) and SmartGlobal Max (a portfolio consisting of US-listed ETFs) monitors your portfolio 24/7 and triggers auto-rebalancing alerts when your portfolio drifts.

3. Artificial Intelligence (AI) Investment

As full-time employees, we all want to have a bit of ‘Me Time’ after a gruelling day at work. Much less have the brain-power still to research and compare individual stocks? Fortunately, in an era of rapid technological developments, many financial products are now integrating big data and artificial intelligence analysis in its offering. If investors are optimistic about certain stocks in individual sectors, they can purchase a basket of similar stocks picked out by A.I programming with one click, thereby diversifying their investment and reducing single stock risks.

Take AQUMON’s SmartStock Portfolio ‘Profit Makers’ as an example. Logically, we all agree that companies that are consistently profitable will likely generate higher stock returns. But how exactly can we identify which companies are consistently profitable when there are thousands of stock choices and even more varying factors that influence stock performance? AQUMON does it in 3 steps by selecting a pool of high-quality stocks. Then the system ranks all the stocks that have been screened with our unique PowerFactor analysis.

Our algorithm selects 10-20 stocks from these rankings and calculates how much to invest in each (i.e. determining their respective portfolio weights). This results in a systematically diverse portfolio of the most consistently profitable US stocks.

- *Above return is the 3-year backtested performance of 'Profit Makers' from 2019-05-03 to 2022-05-03. Investment involves risks. Past performance does not indicate the future.

About AQUMON

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON’s investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

- Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.