How much tax would be deduced from VHIS and how is it calculated?

Under the current tax regulation, taxpayers could buy VHIS for their family members, and apply for VHIS tax deductions on their behalf. Does insuring family members really save more taxes? Bowtie will use the example of “Mr. Wong’s family👨🏼🦲” and four hypothetical case studies to teach you how to save taxes to the fullest!

The Example

Assuming Mr. Wong and his wife 👨🏼🦲👩🏽 have a family of eight, and their premiums are as follows:

- Mr. and Mrs. Wong 👨🏼🦲👩🏽 are both 40 years old and employed;

- Mr. Wong 👨🏼🦲 has the highest income, at the highest tax rate of 17%.

- If he applies for VHIS tax deductions for all his family members; the amount saved would be maximized;

- Both sets of parents are retired and 60 years old.

- Their two children are about to graduate and are both 20 years old.

Based on this, Bowtie will provide four hypothetical case studies to show you how to save taxes to the fullest.

Case 1: Mr. Wong only insures himself👨🏼🦲

Since Mr. Wong is employed and covered by group medical insurance, he purchases a high-end VHIS plan (with deductibles of HK$80k) to top up his group medical insurance. This not only reduces his expenses but also provides greater coverage. After calculation, the tax deduction amount is over $539.

Policyholder: Mr.Wong👨🏼🦲

| The Insured Person | Premiums | x Tax Rate | = Tax saved |

| Mr.Wong👨🏼🦲 | $3,168* | x 17% | = $539 |

- *Calculate the standard premium for a 40-year-old man insuring Bowtie Pink (Ward) with deductibles of HK$80k.

Case 2: Mr. and Mrs. Wong both insure themselves👫

Mrs. Wong👩🏽 is also employed and covered by group medical insurance, so Mr. Wong👨🏼🦲 insures her with the same plan: a high-end VHIS (with a deductible of HK$80k). When both of them are insured, the tax deduction amount is twice as high as Mr. Wong insuring himself alone, over HK$1,070.

Policyholder: Mr.Wong👨🏼🦲

| The Insured Person | Premiums | x Tax Rate | = Tax saved |

| Mr.Wong👨🏼🦲 | $3,168* | x 17% | = $539 |

| Mrs. Wong👩🏽 | $3,168* | x 17% | = $539 |

| Total | $6,336 | $1,078 |

- *Calculate the standard premium for a 40-year-old man/ woman insuring Bowtie Pink (Ward) with deductibles of HK$80k.

Case 3: Mr. and Mrs. Wong and their four children all purchase VHIS👨👩👧👧

Since Mr. Wong’s👨🏼🦲 children are about to graduate and expected to be covered by group medical insurance, he insures them with the same high-end VHIS plan (also with a deductible of HK$50k).

After calculation, the tax deduction amount is 2.5 times higher than insuring Mr. and Mrs. Wong alone, reaching $2,742.

Policyholder: Mr.Wong👨🏼🦲

| The Insured Person | Premiums | x Tax Rate | = Tax saved |

| Mr.Wong👨🏼🦲 | $4,884* | x 17% | = $830 |

| Mrs. Wong👩🏽 | $4,884* | x 17% | = $830 |

| Son👦🏽 | $3,180^ | x 17% | = $541 |

| Daughter 👧🏽 | $3,180^ | x 17% | = $541 |

| Total | $16,128 | $2,742 |

- *Calculate the standard premium for a 40-year-old man/ woman insuring Bowtie Pink (semi-private) with deductibles of HK$50k.

- ^Calculate the standard premium for a 20-year-old man/ woman insuring Bowtie Pink (semi-private) with deductibles of HK$50k.

Case 4: Mr. Wong's entire family of eight is insured🏘️

As you may have guessed when Mr. Wong insures his entire family of eight🏘️, the tax deduction amount will inevitably be higher. Insuring his spouse, even helping his parents and family members to purchase insurance, can result in more tax deductions!

Don’t wait any longer, immediately find out how much tax deduction Mr. Wong can get when insuring his entire family of eight🏘️. Since the four elderly family members are all retired and do not have group medical insurance to support the deductibles of tens of thousands of dollars, Mr. Wong purchases each of them with a VHIS Standard.

This not only provides reasonable premium expenditure but also sufficient coverage (with an annual benefit limit of up to HK$420k).

After calculation, the tax deduction amount is 2.31 times higher than insuring only four people, reaching HK$6,364.

Policyholder: Mr.Wong👨🏼🦲

| The Insured Person | Premiums | x Tax Rate | = Tax saved |

| Mr.Wong👨🏼🦲 | $4,884* | x 17% | = $830 |

| Mrs. Wong👩🏽 | $4,884* | x 17% | = $830 |

| Son👦🏽 | $3,180^ | x 17% | = $541 |

| Daughter 👧🏽 | $3,180^ | x 17% | = $541 |

| Mr.Wong’s Dad🧓🏼 | $5,436# | x 17% | = $924 |

| Mr.Wong’s Mum👩🏼🦳 | $5,220# | x 17% | = $887 |

| Mrs. Wong’s Dad👴🏼 | $5,436# | x 17% | = $924 |

| Mrs.Wong’s Mum👵🏼 | $5,220# | x 17% | = $887 |

| Total | $37,440 | $6,364 |

- *Calculate the standard premium for a 40-year-old man/ woman insuring Bowtie Pink (ward) with deductibles of HK$50k.

- ^Calculate the standard premium for a 20-year-old man/ woman insuring Bowtie Pink (ward) with deductibles of HK$50k.

- #Calculate the standard premium for a 60-year-old man/ woman insuring Bowtie VHIS Standard.

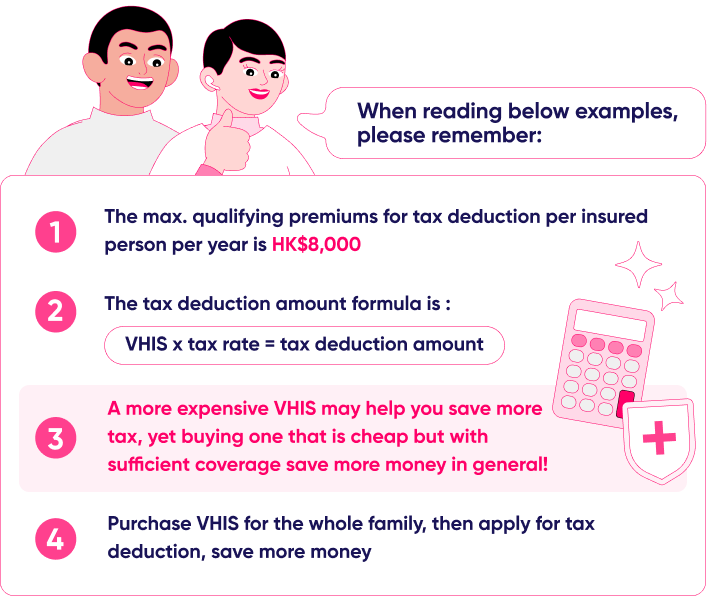

Misconception: Buying more expensive plans can get more tax deductions and save more money. No!

Many people may think that buying a more expensive VHIS plan for themselves/family can result in more tax deductions and greater savings.

It is true that more expensive VHIS plans can result in more tax deductions. But the most cost-effective method is to buy cheaper VHIS plans with sufficient coverage!

Let’s use the example of Mr. Wong’s family of eight🏘️ to extend the calculation of different cost-saving plans.

- Cost-saving plan A: Everyone buys an expensive VHIS plan, reaches the maximum qualifying premium of HK$8,000, and gets more tax deductions!

- Cost-saving plan B (i.e. Case 4): Everyone buys a reasonably priced VHIS plan with sufficient coverage, and then applies for tax deductions!

| Mr. Wong’s family of eight🏘️ | Cost-saving plan A | Cost-saving plan B |

| Actual paid annual premium | $64,000# | $37,440 |

| Qualifying premiums for a Tax deduction | $64,000# | $37,440 |

| Tax deduced Amount

(assuming tax rate as 17%) |

$64,000 x 17%

= HK$10,880 |

$37,440 x 17%

= $6,364 |

| Total Annual expenditure

(actual paid premium – tax deducted amount) |

HK$64,000 – HK$10,880

= HK$53,120 |

$37,440 – $6,364

= $31,076 |

- # To make the calculation easy, let’s treat everyone’s annual premium is HK$8,000.

From the “total annual expenditure”, it can be seen that cost-saving plan B (i.e. Case 4) saves over twice as much as cost-saving plan A!

Buying a cheaper VHIS plan with sufficient coverage and then applying for tax deductions is the “most cost-effective plan”!

- Note: For the convenience of readers, all numerical calculations have been rounded to the nearest whole number.

- Note: Any content related to Bowtie products in this article is for reference and educational purposes only. Customers should refer to the detailed terms and conditions on the relevant product webpage.