Insurance for retirement

Medical insurance saves your retirement fund for medical expenses!

After retirement, not only will your income decrease, but you will also lose the coverage of group medical insurance. If you are ill, the burden of medical expenses will undoubtedly become great.

If you don’t have individual medical insurance, you’ll need to use your “retirement fund,” which can disrupt your original plans and affect the quality of life.

It is well known that the waiting time in public hospitals in Hong Kong is always long. For example, the waiting time for joint replacement surgery is usually counted in years, ranging from 2 to 5 years, depending on the hospital network. This may cause patients to miss the golden time for treatment.

- *Data is taken from the waiting time of patients who have undergone surgery between January 2022 and December 2022.

Private hospitals are indeed a better choice than public hospitals, but treatment costs are generally more expensive. For example, the cost of a total knee replacement surgery (S&N implant) for one knee at Gleneagles Hospital Hong Kong ranges from HK$163,600 to HK$212,710, which can easily become a significant portion of your retirement fund.

If you don’t want to disrupt your retirement plan or even go bankrupt due to medical expenses, you may want to consider purchasing suitable medical insurance (like VHIS) to ensure comprehensive medical coverage.

Are premiums always expensive for seniors?

If you know how to buy, you can get full-covered medical insurance for less than HK$1,000 per month!

Considering the two major issues for the retired people:

- They do not have “group medical insurance”; and

- They may not have many budgets for “premiums”

So We recommend that retirees purchase the Bowtie VHIS Flexi Regular with Bowtie & Gleneagles Hospital Hong Kong Wellness Package (hereafter referred to as the Bowtie Flexi+Gleneagles plan).

Why? Here are the reasons:

- Lower premiums than other full-covered medical insurance plans

After retirement, there is no fixed income from work and the retirement fund will gradually decrease over time. Therefore, before purchasing insurance, you should budget and calculate the premium amount you can afford for the next 10 to 20 years to ensure that it will not affect your quality of life after retirement.

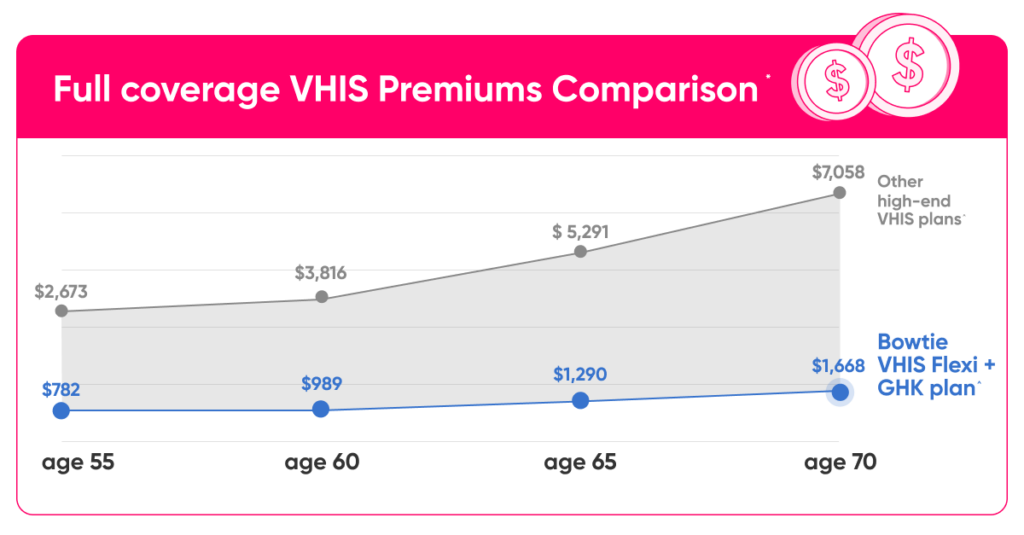

Here is a comparison of the premiums for medical insurance products on the market for non-smokers aged 55 to 70, with a HK$0 deductible:

- *The Bowtie & Gleneagles Hospital Hong Kong Wellness Package is an optional add-on to the Bowtie VHIS Flexi, applicable to specified medical package costs and subject to the annual benefit limit of the Bowtie VHIS Flexi Policy.

- ^The above premium comparison is based on non-smoking males purchasing the Bowtie VHIS Flexi Regular at the relevant ages, with an annual benefit limit of HK$600,000, and adding on the standard premium of HK$200/month for the Bowtie & Gleneagles Hospital Hong Kong Wellness Package. The comparison also includes the average monthly standard premiums for six high-end VHIS plans in the market (as of April 11, 2023) with HK$0 deductible and semi-private ward options.

- Note: Except for the Bowtie VHIS Flexi Plus, premiums for other plans are not affected by gender.

In the long run, if you purchase the Bowtie Flexi+Gleneagles plan, you can not only get full coverage but also pay nearly half the premium compared to other plans. This is particularly suitable for retirees without a fixed income from work.

- Full Coverage for >240 Medical Procedures, Including Common Surgeries

At Gleneagles Hospital Hong Kong, more than 240 surgeries and checkups are fully covered by the Bowtie Flexi+Gleneagles plan, including common procedures in specialties such as cardiology, gynecology, general medicine, orthopedics, ophthalmology, and more. All expenses, including doctor fees, medication, hospitalization, surgery, meals, and more, catering to the medical needs of retirees.

- HK$ Deductible, No Need to Pay Out-of-Pocket Expenses Upfront

As mentioned earlier, retirees no longer have the protection of company insurance to offset deductible costs. If they need to undergo related examinations or treatment when they get sick, the Bowtie Flexi+Gleneagles plan can ensure that policyholders do not have to pay out of pocket and can receive “genuine full coverage.”

Bowtie Flexi+Gleneagles plan can fully cover over 240 surgeries and examinations but the annual benefit limit is just HK$600k, is that enough?

High-end medical insurance plans on the market generally provide coverage of over HK$10 million. In comparison, a benefit limit of HK$600k may seem low. However, according to the internal data of the Bowtie actuarial team, more than 95% of claims related to accidents or illnesses that require half-private ward hospitalization do not exceed HK$400,000.

Therefore, in most cases (while considering the balance of premium affordability), an annual benefit limit of HK$600k is already sufficient. Moreover, the VHIS Flexi does not have a lifetime benefit limit, meaning that the annual benefit limit of HK$600k will be recalculated every policy year.

- ^The Bowtie team reviewed 3,800 high-end medical claims from 8,000 policies over a period of 45 months and found that the average claim amount for the top 5% of claims with the highest medical expenses was only about HK$317,000. The average claim amount for the top 0.5% of claims with the highest medical expenses was about HK$2.286 million.

If you have already developed certain medical conditions, it may be difficult to pass the underwriting or you may need to pay a loading to get insured.

Therefore, Bowtie suggests that individuals purchase suitable medical insurance while they are still healthy and without any suspicious symptoms. This ensures that they can obtain comprehensive medical coverage at the most affordable premium.

Even if you become ill, you don’t have to worry since you can receive appropriate treatment as soon as possible!

Free Annual Health Check and Additional Health Services (Total Value of HK$4,220)

The Bowtie Flexi+Gleneagles plan also offers a free annual health check and additional optional health services, including eye care, professional nutrition guidance, comprehensive liver function and hepatitis tests, and tumor marker tests.