Reversionary Bonus

What is Reversionary Bonus?

If you are unfamiliar with reversionary bonus, you might wonder if it is a guaranteed or non-guaranteed dividend.

If you purchase a life insurance policy with savings components, the policy value generally includes non-guaranteed dividends. Dividends are mainly divided into 2 types: cash dividend and reversionary bonus.

When can Reversionary Bonus be withdrawn?

Cash dividends are like stock dividends and can be withdrawn at any time after they are announced by the insurance company. The amount of cash dividends declared is guaranteed, and policyholders can withdraw it from their policy at any time. Alternatively, they can leave it in the policy to earn compound interest, similar to a bank savings account but with higher interest rates than banks.

Reversionary bonuses are similar to receiving bonus shares instead of cash dividends. The face value of the reversionary bonus announced by the insurance company each year is only for reference and will only be fully paid out in the event of the policyholder’s death. If the policyholder surrenders their policy to withdraw the reversionary bonus, the amount may differ from the announced face value and is typically lower. It is similar to receiving bonus shares and not knowing the final amount until the shares are sold. In fact, for policies that offer reversionary bonuses, the insurance company invests some of the funds in assets with higher volatility, such as stocks. Therefore, there is higher uncertainty, but potential returns may also be higher. The choice depends on whether potential returns or certainty is more important.

The savings products that offer reversionary bonuses may distribute them in the form of terminal bonuses, which means they can only be withdrawn when the policy reaches its maturity date. When does a policy reach its maturity date? Generally, it is when the policyholder surrenders their policy (which may be partial surrender), or when the insurance company pays out a death benefit or when the policy reaches its full term.

The discussion above is all about non-guaranteed dividends. When customers purchase insurance, they refer to the numbers in the policy documents. If the insurance company exaggerates the expected returns and there is a big discrepancy at the time of distribution, it can be a problem for customers who rely on these returns for their financial security.

Is there a mechanism to monitor whether the expected returns of insurance companies are reasonable and reliable?

In the past when there was insufficient transparency, and some insurance companies were overly optimistic in predicting dividends, resulting in a significant discrepancy between expected and actual returns. In response to this, the Insurance Authority has required all insurance companies to publish their fulfillment ratios on their websites since 2017 to provide the public with a reference for dividend performance.

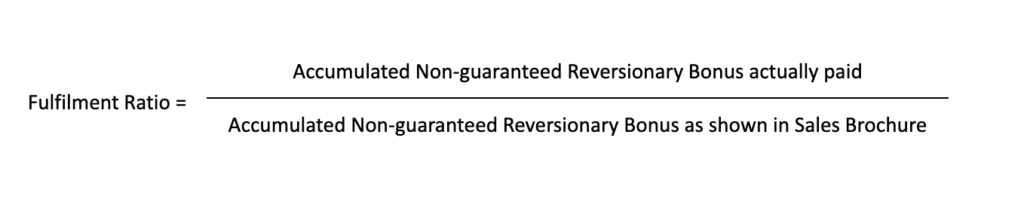

What is a Fulfilment Ratio?

The fulfilment ratio may be affected by various factors, such as investment returns, claims, surrender rates, and administrative expenses.

- If the fulfilment ratio is close to 100%, it means that the insurance company has almost achieved the non-guaranteed benefits expected at the time of policy sale

- If the fulfilment ratio is > 100%, it means that the actual payout amount is higher than the expected returns promised to policyholders at the time of sale

According to regulations, insurance companies must disclose their fulfilment ratios so that customers can understand the fulfillment ratios of different companies.

Example of calculating Reversionary Bonuses

The following is a simple example of how to calculate and understand fulfilment ratios. Assuming the life insurance was issued on January 1, 2021, and on January 1, 2022, the insurance company paid out HK$900 in accumulated reversionary bonuses, the fulfilment ratio for the first policy year would be (900/1,000) = 90%.

If the policy is still in effect on January 1, 2023, and the insurance company pays out HK$1,500 in accumulated reversionary bonuses, the fulfilment ratio for the second policy year would be (1,500/2,000) = 75%. Please refer to the table below for details.

| Policy Year | Accumulated Reversionary Bonus (Cash Value) as shown in Sales Brochure | Accumulated Reversionary Bonus actually paid (Cash Value) | Fulfillment Ratio |

| 1 | HK$1,000 | HK$900 | 90% |

| 2 | HK$2,000 | HK$1,500 | 75% |