Does Life Insurance Cover COVID-19's Death?

Bowtie conducted online research and tried to analyze in detail how COVID-19 affects life insurance application / filing claims. At the end of the article, we will explain how Bowtie handles COVID-19 patient cases.

Does term life insurance cover deaths from COVID-19 ?

From the online search result, as of today, COVID-19 is NOT treated as an exclusion in life insurance. When an insured dies due to COVID-19, or due to vaccination, term life insurance will provide coverage for beneficiaries under normal circumstances.

Bowtie Term Life's protection to COVID-19’s death

Bowtie Term Life provides coverage on death due to COVID-19 or COVID-19 vaccination.

| Death due to COVID-19 | Death due to COVID-19 vaccination | |

| Any coverage? | ✓ | ✓ |

| Sum Assured | Depends on the sum insured when applying the policy (Bowtie Term Life provides HK$0.2M to HK$8M sum insured for customers to choose.) | |

| Learn More about Bowtie Term Life | ||

Can former COVID-19 patients apply for life insurance?

Application success or not is affected by “underwriting”.

Meanwhile, underwriting results are affected by the state and duration of illness, also the health condition (e.g. sequelae after recovery from COVID-19) of the individual insured.

Take Bowtie as an example, the insured has to complete the online underwriting process first. If the insured has suffered from COVID-19, they have to declare it in underwriting. According to the declared context, Bowtie’s underwriters will provide a “health questionnaire” to collect the information of the medical treatments the insured has completed, complications (if any), follow-up treatments, and so on. After that, Bowtie will decide if the policy application is successful or not.

Bowtie Tips

It might take a longer time to proceed with the case than it normally does. But no worries, our underwriters will handle your case as soon as possible.

If you have suffered from COVID-19, how do you declare the information in the Bowtie online underwriting system?

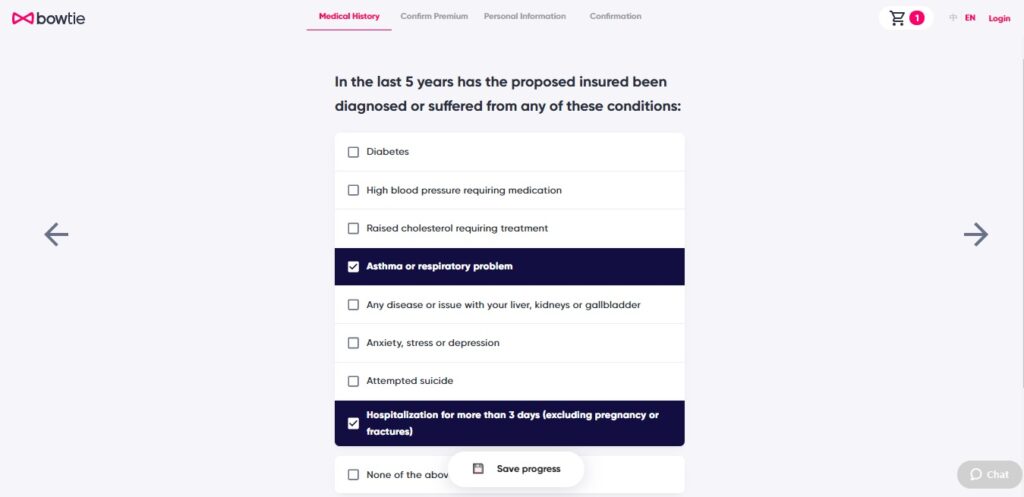

- If the insured has suffered from COVID-19, they need to place a tick in the following questions:

- “Asthma or respiratory problems”

- “Hospitalized for more than 3 days” (Excluding pregnancy or bone fracture) (If applicable)

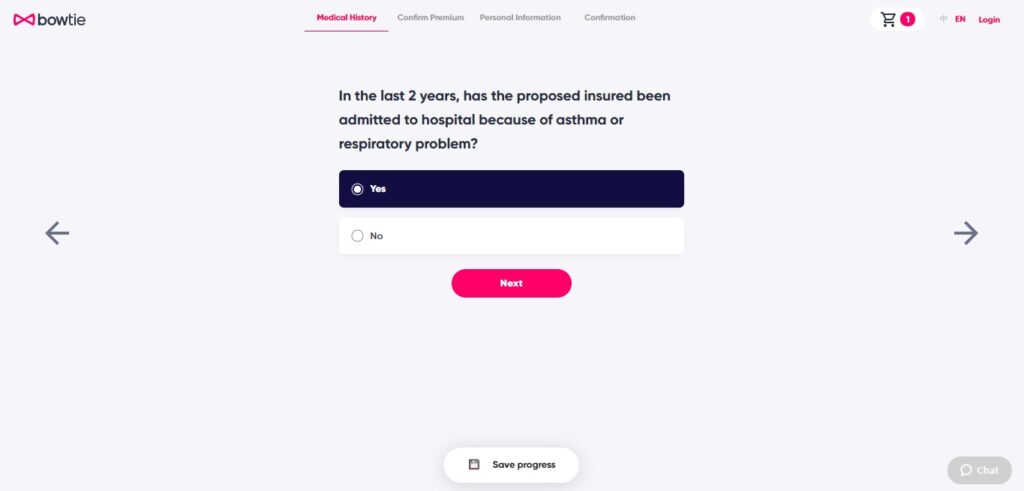

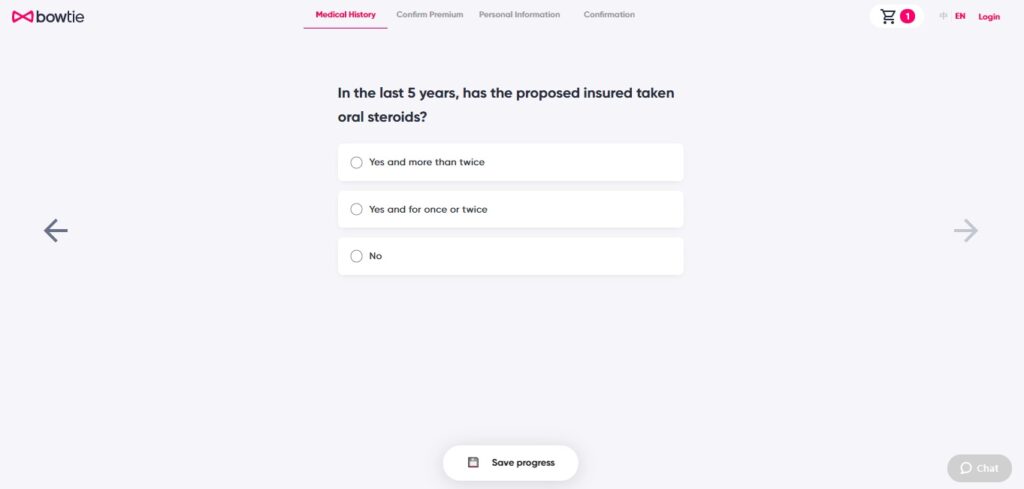

- Based on the treatments you completed, tick the applicable answer in the following question.

- Based on your current condition, tick the applicable answer in the following question.

- After that, there is a question regarding the reason for your hospitalization.

- Since “COVID-19” does not relate to “minor ailments” (include cold, chest infection, minor muscle injury, contraception, visits to chiropractor, physiotherapist or naturopath), please tick “No”.

How much is the premium of Bowtie Term Life?

| Premium for 30-year-old non-smoker male^ | Premium for 30-year-old non-smoker female^ | |

| Premium | HK$150 | HK$115 |

- ^Above Bowtie Term Life premium is estimated based on HK$4M sum assured

- The monthly premiums above are for reference only. The actual premiums are affected by time, inflation, underwriting, Insurance Authority levies and other factors.

Click “Apply now”, you may go through Bowtie’s underwriting process without leaving personal information, and:

- learn whether you or your family can successfully apply for the insurance plan

- learn the actual premium you need to pay

- learn the premium for the next 5 years for reference

Don’t worry, even if you have completed the entire underwriting process, we will not charge you before you confirm to apply!

- Any content related to Bowtie products in this article is for reference and educational purposes only. Customers should refer to the detailed terms and conditions on the relevant product webpage.