How much Life Insurance Coverage do I need?

However, how much life insurance coverage is enough?

There are two main methods for calculating the coverage amount of life insurance, which are the Human Life Value Approach and the Needs Approach.

Human Life Value Approach

Understand the Time Value of Money before calculating coverage amount

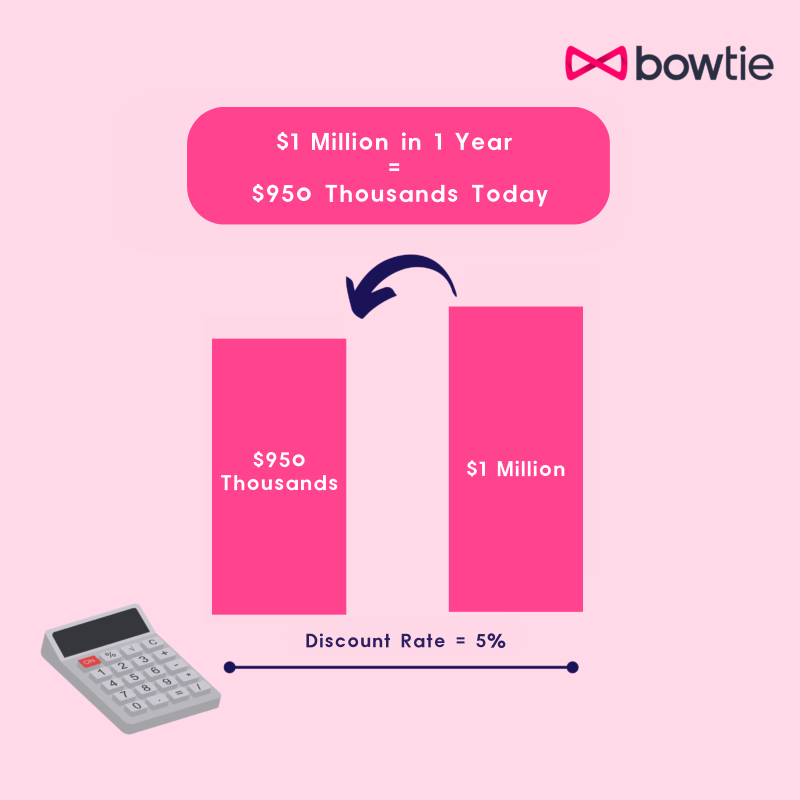

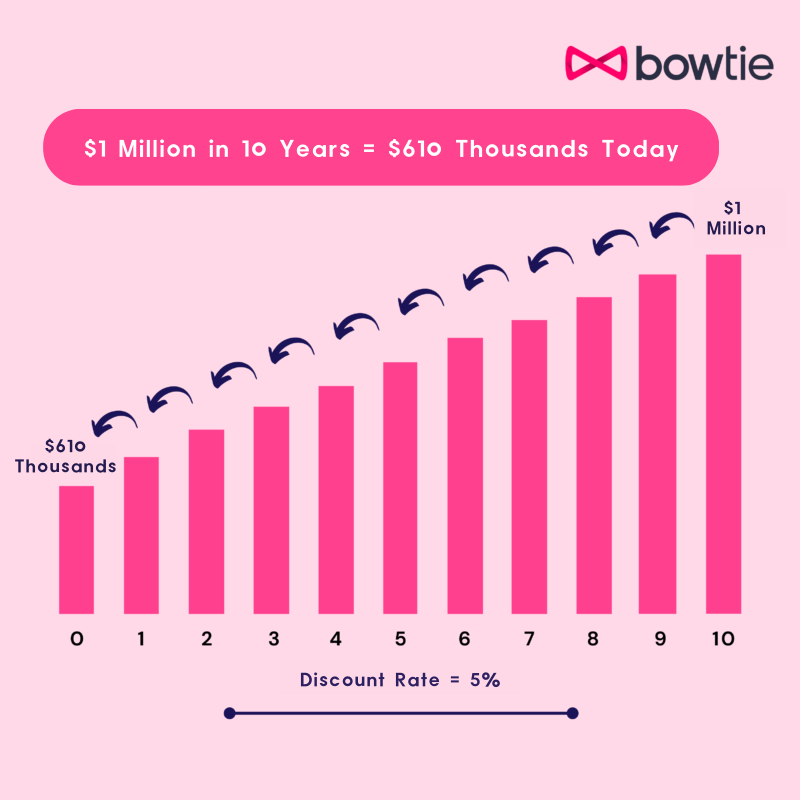

Let’s start with the Human Life Value Approach. Simply put, it is a method for calculating a person’s human worth by discounting their expected future income into present value. Why discount it at present value? Because from a financial perspective, money has a time value, meaning that $1 million received today is worth more than $1 million received 10 years from now.

Many people confuse the time value of money with inflation. In fact, it is not because of inflation that money today is worth more than money in the future, but because $1 million received today can be invested for 10 years, which is the time value of money. The expected investment return rate during this period is the discount rate (or discount factor).

For example, if someone originally expected to receive $1 million in a year, but wants to receive it immediately, and this person expects a reasonable annual investment return rate (also known as a discount rate) of 5%, they only need to possess $952,381 today, which is equivalent to $1 million in a year.

Similarly, if someone expects to receive $1 million in 10 years, but wants to receive it immediately, and expects an investment return rate of 5%, the present value of $1 million in 10 years is $613,913 ($100/1.05^10). The value of $613,913 today is equivalent to $1 million in 10 years.

The discount rate varies depending on the individual, but when calculating life insurance coverage, a conservative approach is generally adopted, such as using the bank’s fixed deposit rate as the discount rate.

For example, a 30-year-old person with an annual income of $300,000 and an expected retirement age of 65, with an annual income growth rate of 4%. Assuming a discount rate of 1.5%, this person’s human worth is $17.07 million (enter the data into a financial calculator or Excel and calculate the present value, as shown in the table below).

| Cash flow (PMT) | – $300,000 |

| Number of periods (N) | 36 years |

| Discount rate (I) | -2.40% |

| Future value (FV) | 0 |

| Present value (PV) | $17.07 million |

The reason for the negative discount rate is because income is expected to grow. The formula is 1.015/1.04-1. This method provides a rough estimate, but does not take into account individual factors such as family responsibilities, existing assets and liabilities, and other factors, so it is not a very accurate method.

Needs Approach

Coverage amount can also be calculated based on actual financial needs

Another method is the Needs Approach, which considers the insured’s actual needs and financial situation, including personal and family responsibilities such as supporting parents or children. Future expected expenses are discounted into present value, and current liabilities such as mortgage payments and other expenses such as funeral expenses are added. Then, subtract the current assets including savings and other investments.

When calculating life insurance coverage, the value of the insured’s primary residence is usually not included in their assets. Why? Because unless the family sells the primary residence for cash to cover living expenses after the insured’s death, the property can only be used as a residence and cannot generate cash flow to meet living expenses.

Moreover, if the primary residence is included in the assets when calculating life insurance coverage, it implies that the family may sell the property for cash when needed. In this case, the future value of rental expenses after selling the property should be discounted into present value, which complicates the problem. Therefore, it is generally not recommended to consider the primary residence as an asset when calculating life insurance coverage.

Here is an example. Suppose a 35-year-old man has a 3-year-old daughter. In the event of his untimely death, he hopes to fulfil his responsibilities as a husband and father, including paying off the mortgage on his property and setting aside money to ensure that his daughter can complete her education. The details and calculations are shown in the table below.

| Responsibility to Support Daughter (A) | ||||

| Annual Expenses | Expected Inflation | Years | Present Value | |

| Child’s Kindergarten and Other Expenses | $120,000 | 4% | 3 | $368,940 |

| Primary School Tuition and Other Expenses | $180,000 | 4% | 6 | $1,098,547 |

| Secondary School Tuition and Other Expenses | $228,000 | 4% | 6 | $1,271,225 |

| University Tuition and Living Expenses | $600,000 | 4% | 4 | $1,991,738 |

| $4,730,451 | ||||

| Liabilities (B) | ||||

| Mortgage | $5,000,000 | |||

| Other Expenses (C) | ||||

| Funeral Expenses | $300,000 | |||

| Assets (D) | ||||

| Cash | $500,000 | |||

| Other Investments | $500,000 | |||

| Life Insurance Needs (A) + (B) + (C) – (D) | ||||

| $9,030,451 | ||||

From this example, it can be seen that using the Needs Approach to calculate life insurance coverage is more accurate and can better meet the actual needs of the policyholder compared to the Human Life Value method. However, the individual needs to have a clear understanding of their own needs and use more information to make the calculation.

Term Life Insurance premiums are more affordable

Regardless of which method is used, the calculated life insurance coverage amount is likely higher than what most people expect. Is it because the above methods overestimate the coverage amount, or because most people underestimate their actual life insurance needs?

This is something for readers to ponder. However, one thing to note is that most people feel that a coverage amount of $9 million is quite large, which may be because traditional life insurance products sold are mainly whole life plans. If someone were to purchase a $9 million whole life insurance, it would indeed be very expensive.

The main purpose of purchasing life insurance is to complete one’s unfulfilled responsibilities through insurance. If these responsibilities are not lifelong, is it necessary to purchase a Whole Life Insurance? Of course, if someone is purchasing life insurance for other reasons, such as wealth inheritance, that is a different story.

In fact, if someone were to purchase a $9 million Term Life Insurance, the premium would be affordable for most people.