Does Cancer Insurance Cover Carcinoma In Situ?

What is carcinoma in situ?

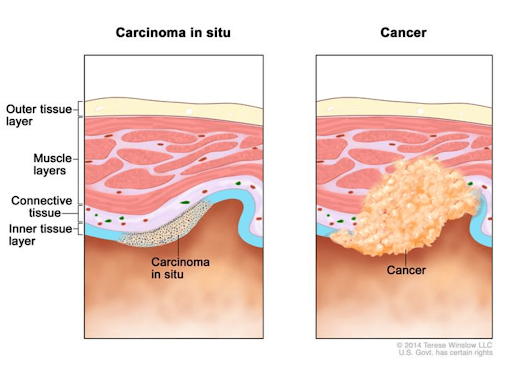

Carcinoma in situ (also known as stage 0 cancer) is the earliest stage of cancer. At this stage, cancer cells are only present at the site of origin and have not spread to neighboring tissues, and do not have invasive properties. However, if carcinoma in situ cells are not treated in a timely manner, there is a chance that they may spread to other parts of the body and become invasive cancer.

As cancer cells only occur in the original cells, surgical removal can cure carcinoma in situ. It is also the “cancer” with the highest cure rate! A foreign study showed that between 2008 and 2014, the cure rate for bladder carcinoma in situ patients in the United States reached 95%. Early detection and treatment can greatly increase the cure chance!

5 common types of carcinoma in situ

Although the cure rate for carcinoma in situ is high, not every cancer has stage 0. The 5 common types of carcinoma in situ are:

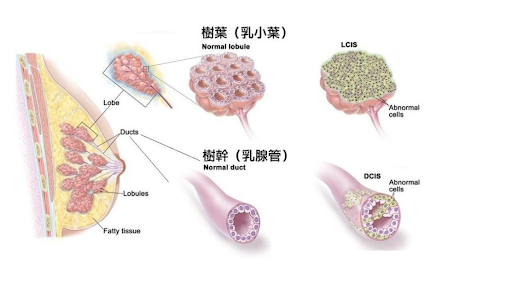

- Ductal carcinoma in situ (DCIS) and lobular carcinoma in situ (LCIS) are common breast CIS; while DCIS is more likely to develop into invasive malignant tumors.

- Cervical carcinoma in situ: The cancer cells are hidden on the surface of the cervix and can be detected through a Pap smear.

- Bladder carcinoma in situ: In people who are first diagnosed with bladder cancer, 3% have carcinoma in situ, most of whom are male smokers aged 60-70.

- Adenocarcinoma in situ: The cancer cells appear as a ground-glass opacity (CGO) and are not easily distinguishable.

- Cutaneous carcinoma in situ: Also known as Bowen’s disease, the skin has a precancerous lesion due to long-term exposure to the sun, presenting as a red patch, commonly seen on the face, ears, or neck.

Why is breast cancer often related to carcinoma in situ?

According to data, 37% of breast cancer patients are diagnosed with carcinoma in situ, and 85% of those with carcinoma in situ have DCIS.

20% to 30% of DCIS patients may progress to malignant or invasive breast cancer.

As mentioned above, of the two types of breast carcinoma in situ (DCIS and LCIS), DCIS is more aggressive and diverse, with solid and papillary forms. It is more likely to become malignant cancer compared to LCIS. Therefore, once detected, it should be promptly removed and treated.

How is carcinoma in situ treated?

The main treatment method is surgical removal. To prevent carcinoma in situ cells from transforming into malignant tumors and spreading to other tissues, doctors usually use surgery to remove the affected cells and may also use radiation therapy to reduce the risk of cancer cell recurrence, depending on the situation.

Since most carcinoma in situ are hormone receptor-positive, patients also need to take anti-hormonal drugs after surgery to reduce the chance of recurrence.

For example, in the case of breast cancer, patients can choose to have the entire breast removed or undergo breast-conserving surgery.

Breast-conserving surgery needs to be accompanied by adjuvant radiation therapy to completely eliminate cancer cells, but radiation therapy has certain risks. Even if the entire breast is removed, breast reconstruction surgery can be performed to reduce changes in appearance.

Since carcinoma in situ has not yet spread, patients may not necessarily need to undergo axillary lymph node dissection. According to foreign studies, the survival rate of DCIS patients after 10 years of cure can be as high as 98% to 99%!

Not all medical or critical illness insurance covers carcinoma in situ

According to a survey conducted by the Consumer Council in 2017, most critical illness or medical insurance policies in the market include terms such as “carcinoma in situ and cancer”, but not all carcinoma in situ or cancer is covered.

This is because each insurance policy has a different definition of “carcinoma in situ” or “early-stage cancer”, and some cancer-related symptoms are not covered, such as Pre-cancerous lesions, benign tumors, tumors with HIV, congenital or hereditary cancer, etc.

In addition, some policies state that if the Insured Person has had symptoms of certain cancer or been diagnosed with it within a certain age range, the insurance company may not accept the claim.

Before purchasing critical illness or cancer medical insurance, be sure to carefully read the policy terms and conditions, understand the coverage scope, and give yourself peace of mind!

Will Bowtie VHIS cover "carcinoma in situ"?

Taking Bowtie VHIS Flexi Regular as an example, the coverage for “surgical fees for surgeons” ranges from HK$5,000 to HK$50,000, depending on the complexity of the cancer or surgical procedures required.

Therefore, the coverage for carcinoma in situ depends on the surgical complexity.

In addition, Bowtie VHIS Flexi Regular provides coverage for the following two items that patients with certain types of cancer may need:

| Items | Benefit Limit (reset every year) |

| Prescribed diagnostic imaging tests

Included:

|

HK$26,000 / year (with 30% co-insurance) |

Prescribed non-surgical cancer treatments Included:

|

HK$80,000 / year |

| Know more about Bowtie VHIS Plans’ Coverage | |

In addition to diagnosis, surgery, and treatment, other eligible hospitalization expenses, such as “room and board”, “Attending doctor’s visit fee”, “specialist fees”, and “miscellaneous fees”, are also covered under Bowtie VHIS. If you want to know the coverage amount for each item, you can refer to the relevant coverage items of “Bowtie VHIS Flexi”.

Bowtie Cancer Fighter Plan fully compensates for carcinoma in situ

Bowtie’s cancer medical insurance “Cancer Fighter” covers all levels of cancer, including carcinoma in situ, and reimburses the actual costs from diagnosis, monitoring, surgery, treatment, and medication expenses (including targeted therapy and immunotherapy), without the need to pay any deductible.

The lifetime benefit limit can be as high as HK$3 million.

The majority of the coverage items are also eligible for full coverage. If you want to know the benefit amount for each item, you can refer to the relevant coverage items of Bowtie Cancer Fighter.

How good are Bowtie VHIS and Cancer Fighter?

| Bowtie VHIS Flexi |

|

| Bowtie Cancer Fighter |

|