Beneficiary of Life Insurance

Policyholder vs Insured vs Beneficiary

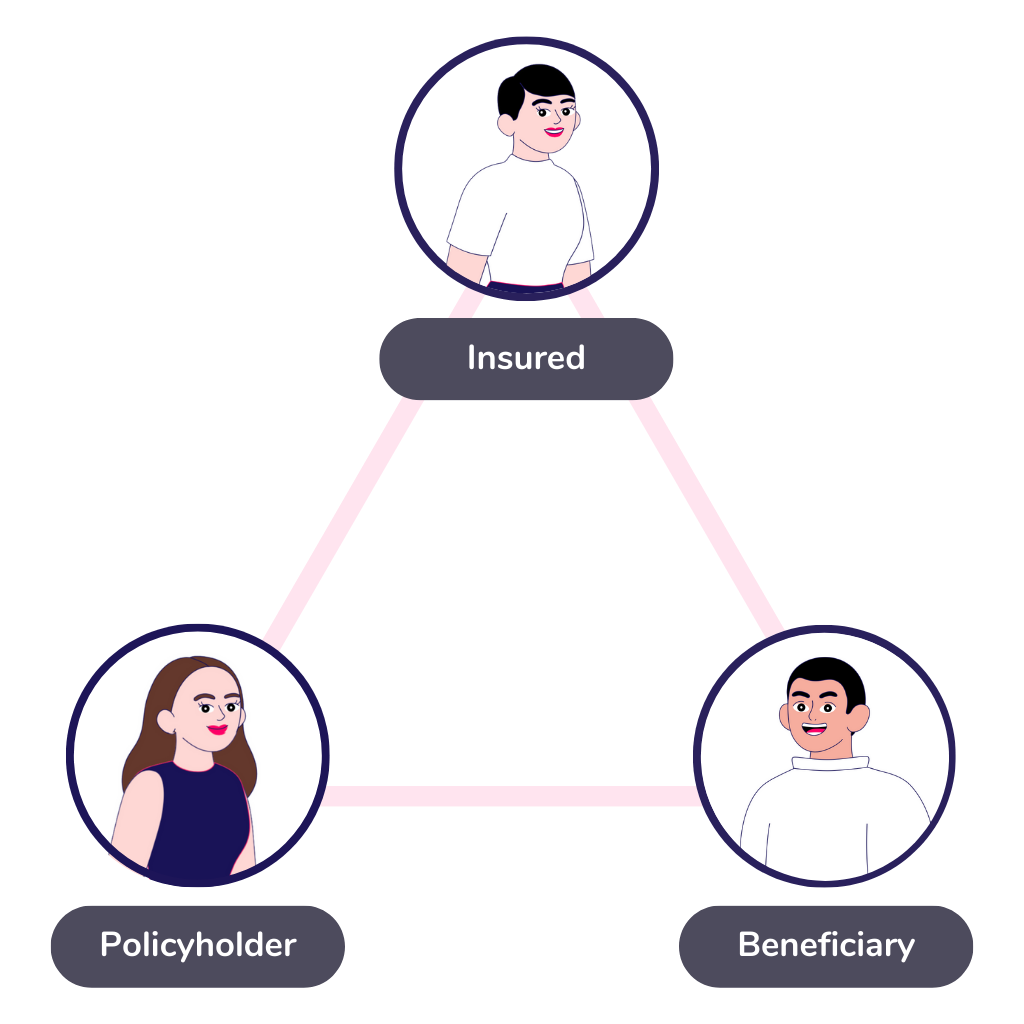

Many people buy life insurance as a way to provide additional security for their loved ones. However, there is a “triangular relationship” that not everyone is aware of. This article will explain the roles of the policyholder, insured, and beneficiary.

Policyholder: The policyholder is the person who applies for insurance and enters into a policy with the insurance company. They can handle policy matters such as changing information, surrendering the policy, or accessing the cash value. Generally, policyholders must be at least 18 years old.

Insured: The insured is the person who is covered by the policy. The policyholder can be the insured, but they can also be two different people. Premiums are usually based on the insured’s age, health, and lifestyle factors, so they cannot be changed in most cases (although some new life savings insurance plans allow for a change of the insured). Some policies, such as annuity policies, can have more than one insured, such as a couple who both apply for coverage.

Beneficiary: The beneficiary is the person who can apply for compensation after the insured meets the claim requirements. For example, in a life insurance policy, if the insured dies, the beneficiary can receive the insurance payout. There can be multiple beneficiaries, and they can receive different percentages of the compensation.

Beneficiary must have an insurable interest

If you purchase life insurance for yourself, you are both the policyholder and the insured, which is the most common scenario.

However, if you are buying insurance for someone else, it is important to note that there must be an “insurable interest” between the policyholder and the insured. In the case of life insurance, anyone who purchases insurance for another person’s life will undoubtedly suffer some form of loss (whether emotional or economic) after the insured’s death. Emotional loss may come from the love and affection that arise from marriage, blood relationships, and other intimate relationships. Spouses and children under the age of 18 have insurable interests. Therefore, you can purchase life insurance for your spouse and children under 18, but you generally cannot purchase life insurance for strangers.

However, there are some special examples beyond blood and fixed family relationships, such as debtors, business partners (especially those involved in personal businesses such as performers and musicians), and contractual relationships (such as key employees of a company) all have insurable interests, but whether they are eligible depends on the insurance company.

If the policyholder and insured do not have insurable interests, the policyholder or other beneficiaries will not be able to exercise the claims rights granted by the policy. However, it should be noted that insurable interest only needs to exist at the beginning of the contract, and even if there are subsequent changes, it will not affect the validity of the policy. For example, divorce is a common example. If either spouse purchases life insurance for their spouse’s life, the policy will remain valid even after a divorce.

Who is eligible to be beneficiary?

As for the insurance beneficiary, it can be an individual, an estate, a company, or a non-governmental organization (such as a charitable organization).

In order to avoid moral hazards, insurance companies will apply the concept of “insurable interest” as a consideration. Many times, only direct relatives, spouses, or legal heirs of the insured will be accepted as beneficiaries.

In other words, insurance companies will not accept ordinary friends as beneficiaries. However, a long-term partner or fiancé(e) will be accepted, but the insurance company may have specific requirements, such as requiring a declaration of a public commitment relationship between the partner and the insured for at least 6 months and both parties being over 18 years old.

Additionally, it is necessary to confirm that you (as the policyholder/insured) are alive and that the insurance payout is in the beneficiary’s interest if the insured passes away and will cause economic loss or difficulties. As different insurance companies have different approaches, it is important to consult with the insurance company.

Sometimes parents/grandparents may fill in their children/grandchildren as beneficiaries. Beneficiaries can be under 18 years old, but the policyholder should arrange a guardian and/or trustee to receive and manage the insurance proceeds on their behalf until they reach adulthood. After reaching adulthood, they can directly receive all the insurance proceeds.

What happens if the beneficiary dies earlier than the insured?

If the beneficiary unfortunately dies earlier than the insured and there is no new beneficiary designated, the compensation will be treated as part of the insured’s estate.

Can charitable organizations be beneficiaries?

In addition, policy donation has become more popular in recent years, with some people using the insurance proceeds for charitable purposes. Generally, charitable organizations or trust groups with public nature can be designated as policy beneficiaries in the company’s name.

The policyholder only needs to fill in the charitable organization’s name and registration number in the beneficiary column and decide the percentage of the donation amount for compensation.

Can we change, add, or delete beneficiaries?

By now, it is believed that everyone has a better understanding of the triangular relationship between policyholders, insureds, and beneficiaries. Basically, the policyholder has the greatest control over the policy. After the policy is issued, the policyholder can change beneficiary information at any time, such as adding or deleting beneficiaries or modifying the percentage of compensation entitlement. However, if the existing policy has an irrevocable beneficiary, the beneficiary cannot be changed without their consent.

“Irrevocable beneficiaries” are common in traditional insurance, but Bowtie life insurance policyholders can log into the online platform to change beneficiaries at any time for flexibility and convenience.

Do beneficiaries only appear in life insurance?

Beneficiaries may appear in life insurance policies, but they also appear in other types of policies, most commonly those with death benefit clauses, such as some medical insurance and annuity plans, which designate who the insurance company will compensate if the insured dies. However, if there is no death benefit clause, beneficiaries may not need to be filled in for medical insurance policies because it implies that the insured must be the beneficiary, and only the insured can apply for compensation.