We keep saying “Debug”, but what are the shortcomings of traditional group medical insurance?

Editor’s sharing: Group medical insurance is an important employee benefit. I study the detailed benefits and coverage of medical insurance offered by each job. Therefore, whether or not your company is using Bowtie’s group medical insurance, it is recommended that everyone learn about the medical insurance benefits that you are entitled to!

In an era of rapid technological development, many companies have undergone a digital transformation in the past decade. For example, the Hybrid Working Model has become the new norm due to the epidemic in recent years; on the contrary, while the health insurance system is closely related to the interests of workers, it has not seen much progress. As the first virtual insurance company in Hong Kong, Bowtie’s unique positioning has allowed us to observe the entire industry from a different perspective. Thus, we’ve noticed that traditional group medical insurance may not keep pace with the fast-changing technological development.

We hope to provide everyone with the right protection. Traditional group medical insurance has been designed for many years, and its products may not consider the actual medical or business needs of the company or team. Whether you are an employee of the HR Department or not, you may have encountered the following problems:

- The policy terms and claims procedures are too complicated, and it takes time for employees and HR to understand the information.

- It is difficult for employees to avoid revealing part of their personal medical records when interacting with HR.

- Handling claims through HR increases their workload and may also prolong the claims process.

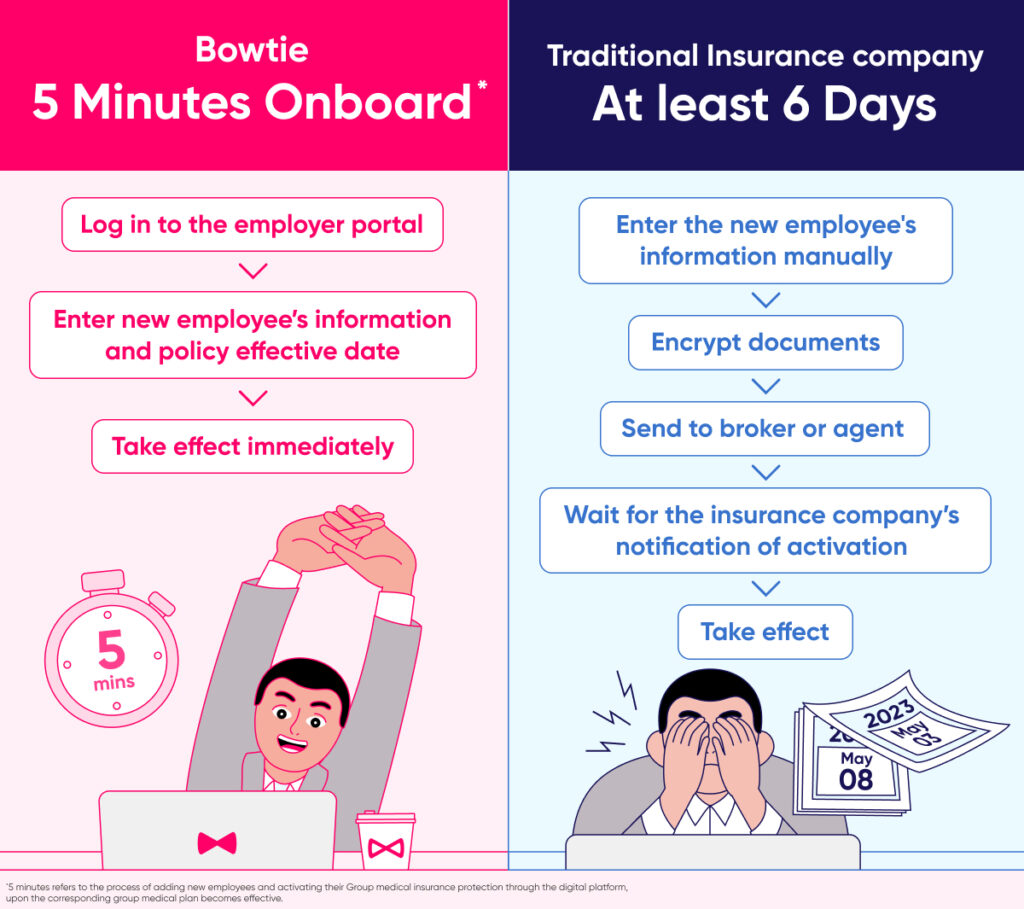

- HR has to submit or complete relevant documents for all incoming/outgoing employees and the paperwork is cumbersome, it is burdening to process excessive documents in a short period of time.

In order to offer better insurance products, Bowtie is dedicated to “debug” the above industry pain points! Let’s have real group medical insurance claims cases speak for us!

Case 1: Possible to claim for the surgery in a private hospital?

We often learn things the hard way, and insurance is no exception. Do you know the “hospital benefit limit” of your policy? You’re not alone in neglecting to pay attention to the policy details when the group medical insurance takes effect upon your starting a job. However, when an accident or a disease occurs, the “hospital benefit limit” determines whether you can receive high-quality medical services and recover in peace. In fact, besides individual medical insurance, comprehensive group medical insurance can also share an employee’s medical costs of getting major surgery in a private hospital!

Mr. Chan (pseudonym), a man in his 30s, worked in a local listed company. He had always been an excellent physique with no health issues. However, accidents often strike at unexpected times—his left shoulder, pelvis, and chest wall were injured in a sports accident. Since the accident happened on a Saturday, Mr. Chan didn’t want to bother his HR colleagues on a weekend. Mr. Chan, unfamiliar with the group medical insurance, called Bowtie’s customer service team to learn more about his medical insurance plan. They immediately suggested Mr. Chan seek medical treatment at a nearby private hospital. After learning that his medical insurance included a “hospital benefit” of HK$80,000, Mr. Chan decided to follow the advice and go to a private hospital for more comprehensive treatment.

Mr. Chan was hospitalized for ten days due to the accident and underwent two surgeries: “Open Reduction and Internal Fixation for Left Clavicle Fracture” and “Left thoracostomy with Chest Drain Insertion.” During this long process, he communicated with Bowtie’s claims team. He even relayed the doctor’s recommended surgeries and details to the claims team to ensure that his medical insurance plan covered the treatment costs. Based on Mr. Chan’s detailed information, the claims team was able to acquire the treatment details and approved a claim amount of up to HK$80,000.

Case 2: Embarrassed when submitting a claim form to HR?

It is embarrassing when you disclose your personal information to HR for a claim application. So, Bowtie also offers a simple and easy-to-understand claims process such that Bowtie’s customers do not have to ask HR for help when making a claim. This reduces HR’s workload and protects the insured’s privacy, killing two birds with one stone!

The case of Miss Wong (pseudonym), a woman in her 30s, demonstrates the excellence of Bowtie’s claims process. Ms. Wong worked in a start-up tech company. After noticing something abnormal about her body, she guessed that there was something wrong with her uterus, so she checked her medical insurance coverage from Bowtie’s website and called the customer service staff to ask whether her policy covers the relevant surgery and examination. After understanding the medical insurance coverage, she contacted a private doctor she knew well and made an appointment to go to a private hospital for diagnosis and treatment on a public holiday. After the consultation, the doctor suspected she was suffering from “endometrial polyps.” The doctor advised her to undergo surgical treatments, including “hysteroscopy, dilation and curettage, and polypectomy.”

After the surgeries and two days of inpatient care, Ms. Wong was in better shape. Following the doctor’s advice, she returned to the hospital for a follow-up consultation. Ms. Wong was pleasantly surprised to find that Bowtie covered her follow-up consultation expenses. In the end, Ms. Wong successfully claimed up to around HK$43,500 within 7 working days without having to reveal personal medical records or assistance to her HR colleagues.

- *The above cases are for reference only, the actual reimbursement is subject to the individual circumstance.

Bowtie is now affording protection to more than 60,000 Hong Kongers. The above are just 2 stories. Whether you have group medical insurance, individual health insurance, or haven’t taken out any Bowtie product yet, we want you to know that with Bowtie coverage, you can rest assured; we’re here for you whenever you need us!

Learn about the claims process or get help from specialists

📞 Customer Service Hotline: 3008 8123

📞 Claims Hotline: 3001 5670