When you compare the voluntary health insurance scheme(VHIS) plans provided by insurers, you may consider several factors. Bowtie’s co-founder and co-CEO, Fred Ngan has talked with 100 customers and have asked them to share what they did consider before getting their VHIS plans.

Why did you choose a virtual insurer?

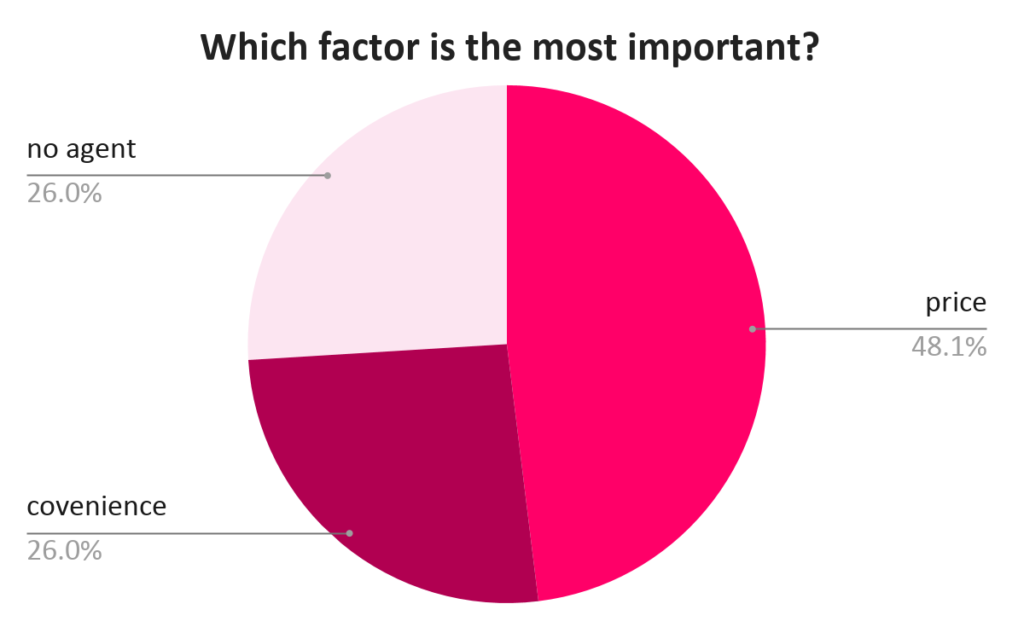

The interviewed customers are a price sensitive crowd. I spoke with customers who even remembered how many dollars our monthly premiums were cheaper than other comparable products. Half of them mention price as the motivation to pick a virtual insurer.

Bowtie has the lowest VHIS premiums for both men and women aged 0 – 75 years old. These cost savings add up quickly. Given the same standardized plan, our customers can end up saving as much as 260% in premiums.

I am incredibly proud of our team who has enabled this disruptive cost structure, so that we can pass on these savings to our customers.

A quarter of the interviewed customers chose us for convenience. Customers appreciate being able to get a price quotation instantly. More importantly, they know right away if they are eligible for coverage. Many of these customers are buying insurance in the evening, when they finally have time to catch up on personal time. That’s how convenient Bowtie is.

One-third of the interviews customers appreciate our self-serve agent-free purchase experience. They want to be in control of their buying decision, switching over from other providers because of unhappy experience with agents or unexpected changes to their premiums.

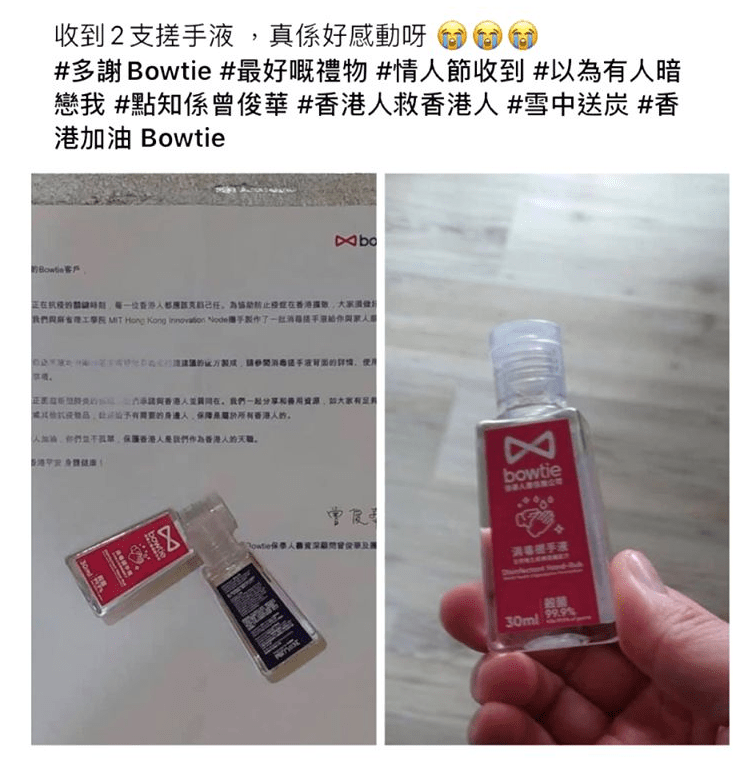

While customers obey social distancing rules due to COVID-19, a digital insurer is another safe way to get insurance that our customers can rely on. We also respect the privacy of potential customers who are only seeking information, sharing with them as many details as possible, and only asking for personal information when creating a binding offer.

In one case, a customer shared that her elderly mother had for years refused to buy any medical insurance because of the medical check-ups needed to complete underwriting. Our online-only underwriting questions helped the customer purchase medical insurance without having to visit a medical center.

Why do you trust us?

Many of our interviewed customers took the time to dig into our company’s history. They were curious about how my co-founder and I started a company in an industry with so many entrenched players. It does read a little bit like David versus Goliath.

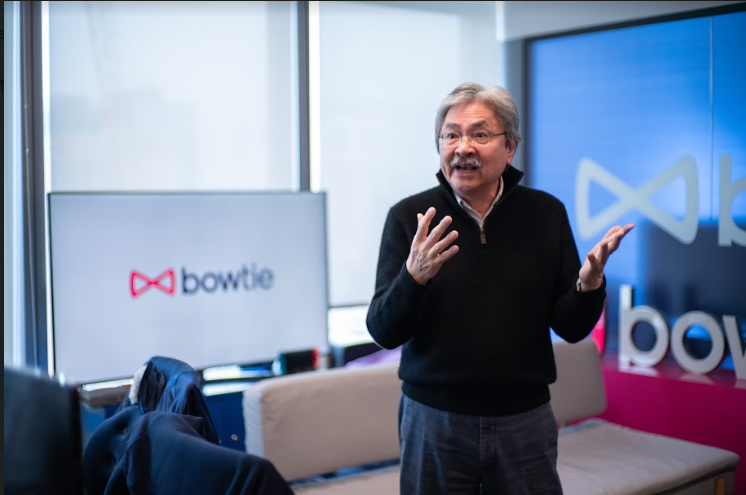

When they realized that John Tsang is one of our most fervent supporters, our customers were positively surprised. John is working with us as a senior advisor due to our youth and energy, social purpose and disruptive technology. We’re proud that our customers agree with John.

We’re also proud to be working closely with our biggest backer – Sun Life. By leveraging their history and expertise, we successfully became the first virtual insurer approved by the Hong Kong Insurance Authority.

Over time, we will continue to build trust with customer engagement and reviews. Many customers cite brand transparency and referrals as important motivators. Basic information about premiums and fees are still unavailable from many companies, and we want to change that.