Do children need to buy Critical Illness Insurance?

Most common critical illnesses in children

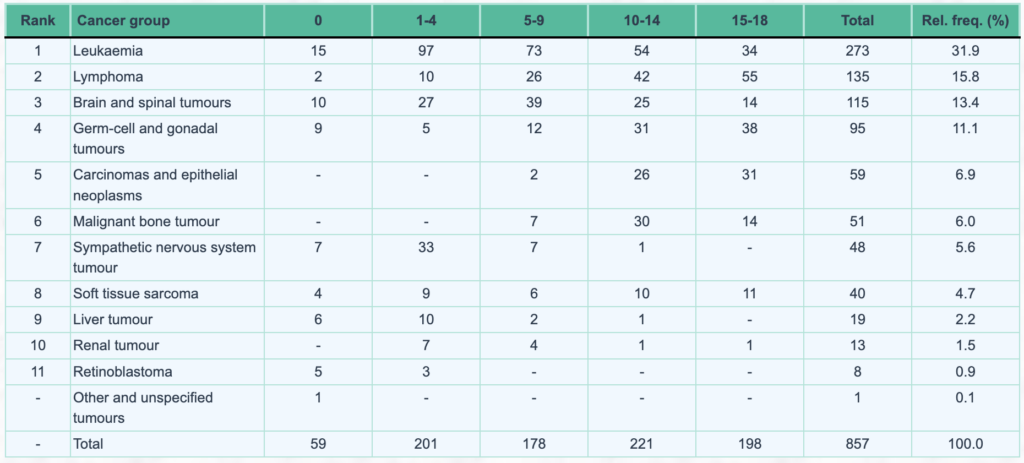

According to statistics from the Hong Kong Cancer Registry website, in the age group of 0 to 18 years, there were an average of 171* new cases of cancer annually from 2016 to 2020. The more common cancers include leukemia, lymphoma, primary brain tumors, and they account for over 60% of the total.

In addition to cancer, children also commonly suffer from Kawasaki disease, severe asthma, rheumatic valve disease, severe hemophilia A, hemophilia B, and Still’s disease.

Furthermore, according to data from the Youth Diabetes Action (YDA), approximately 10% of the population in Hong Kong (about 700,000 people) has diabetes, and an average of 7 children are diagnosed with diabetes every month. The rate of children with diabetes has also been increasing over the past 10 years.

- *Annual average number of new cases of cancer between 2016 and 2020 (divide the 5-year total by 5)

Why do children need to buy Critical Illness Insurance?

Using cancer as an example, if we look at the numbers alone, the proportion of children with cancer is indeed not high. In terms of new cancer cases, children account for only about 0.4%^.

There is a misconception that the chances of children (referring to the age group of 0 to 18 years) developing serious illnesses are generally lower than adults, so there is no need to prepare insurance for children.

However, this is not the case. Taking leukemia, commonly known as blood cancer, as an example, the cure rate for children can be as high as 80%, but the associated medical expenses can vary greatly.

- ^Using 2020 figures as an example, the number of new cases of cancer in children is 165, while the number of new cases of cancer overall is 34,179.

In addition, as parents, you definitely want your children to grow up healthy. If your children unfortunately suffer from a major illness, you would naturally want to take care of them wholeheartedly. It may be inevitable for parents to resign or reduce their working hours, which will undoubtedly increase the financial burden on the family. If there is insurance coverage, it can provide a certain level of support. These are all reasons why children also need to buy critical illness insurance.

How much coverage do children need for Critical Illness Insurance?

If you are preparing critical illness insurance for your children based on the aforementioned logic, you can consider the parents’ household income as the basis for insurance coverage.

Assuming that it takes 3 years for treatment and recovery after suffering from a major illness, the critical illness coverage for children can be three times the parents’ annual income.

In fact, the development of insurance technology has made online insurance applications more convenient. Interested families can quickly obtain quotes for relevant plans online to fill any gaps in coverage.

The premium for critical illness insurance is influenced by the coverage amount, the age and gender of the insured.

Assuming each parent has a monthly income of HK$30,000, an annual income of HK$720,000, and a 3-year income of HK$2,160,000. The following premiums are based on a coverage amount of HK$2,160,000:

Boy

| Age | Bowtie Term Critical Illness Premium | Bowtie Term Critical Illness Multiple Cover Premium |

| 0 | HK$143 | HK$185 |

| 5 | HK$103 | HK$134 |

| 10 | HK$86 | HK$112 |

| 15 | HK$98 | HK$127 |

Girl

| Age | Bowtie Term Critical Illness Premium | Bowtie Term Critical Illness Multiple Cover Premium |

| 0 | HK$158 | HK$192 |

| 5 | HK$108 | HK$131 |

| 10 | HK$86 | HK$105 |

| 15 | HK$116 | HK$140 |

FAQs

Currently, there are critical illness insurance plans specifically designed for children in the market, mainly targeting common illnesses in children, such as severe asthma, autism, and severe epilepsy.

It’s worth mentioning that insurance products are always evolving. Some children may suffer from congenital critical illnesses, so some insurance plans can be purchased before the child is born, providing even more peace of mind. Policyholders should pay attention to these details, which are the main differences from adult critical illness insurance.

Critical illness insurance and medical insurance serve different purposes and provide different coverage scopes. If children do not have any coverage, it is recommended to prioritize purchasing VHIS, which can provide comprehensive coverage.

If there is additional budget, then consider purchasing critical illness insurance as well!