This is the 2nd year we’re giving out a free upgrade to all of our VHIS Flexi customers. It is also the 3rd year we have been insisting to not raise prices while Hong Kong’s medical inflation looks to exceed 8% this year.

So what did we upgrade and how did we do it? Let us explain how this works behind-the-scenes 👇

Why are we doing this?

With Bowtie, we understand you’re buying “health coverage” from us, and that needs to evolve as the world does. We don’t think of your insurance as just a fixed legal contract, or something that we can sell you and forget about later.

Instead, we are constantly improving the VHIS Flexi you have with Bowtie. Imagine it as your Tesla car, or iPhone, or Netflix, where you get regular software and content upgrades.

Unlike many other insurers, Bowtie’s products don’t have a savings and investment component, or surrender charges, or large upfront payments. You pay us monthly and you are free to terminate anytime. That means the responsibility is on Bowtie to continue improving our services and meeting your needs, so that you stay with us. Although this implies more hard work for us, we believe it’s the better business model, and we’re glad to have you trust us on this journey.

What was upgraded this year?

We upgraded 7 benefits, mostly around 4 areas:

- Surgery coverage enhancement

Surgeon’s Fee, Anesthetist’s Fee and Operating Theatre Fee’s were increased by 20% to reduce the out-of-pocket expenses. We try to make sure that even some of the most expensive surgeries are well-covered by our VHIS Flexi plans.

- Basic coverage enhancement

Room and Board and Miscellaneous Charges were enhanced 5-29% to reduce customer shortfalls.

- Pre- and post- Confinement/ Day Case Procedure outpatient care

We increased the pre- and post-confinement outpatient care coverage by 18-55%. We also increased the number of outpatient visits before confinement to cover our customers getting medical second opinions, so customers can make more informed decisions for better treatment outcomes.

- Day Case Procedure Cash Benefit

We increased the Day Case Procedure Cash Benefit up to 63% as many procedures are becoming more convenient and more cost effective when done in outpatient settings now, and are becoming more popular with our customers too.

We also reduced the waiting period for unknowing pre-existing conditions from a 4 year grading scale to 1 year only, which means 100% coverage from second policy year onwards.

We were happy to be able to do all of the above upgrades without a premium increase, again.

The details: how we decide on the upgrades

Every year, we review the experience of our customers for mapping out how we can enhance our VHIS Flexi plans. We consider four different factors:

- We look at the claims experience of our customers.

This is the most important factor because it tells us how you actually used and experienced your VHIS plan. Our main goal is to keep the benefits comprehensive enough that your out-of-pocket is within a very reasonable amount. This means you can get private medical care treatment with a peace of mind that the money is already taken care of.

- We talk to people.

We talked to our customer service and claims teams. This gives us valuable feedback that doesn’t show up in cold data.

- We compare our plans to the market.

There’s no shame in bringing in good ideas that others have had to better serve our customers. We also make sure our plans competitive and keep their marketing edge sharp. Meanwhile, we’re cautious that some benefit designs on the market might lead to higher premium inflation down the road though. These designs may look attractive to customers now, but we keep them out to our plans to make future premiums more sustainable.

- We listen to what you say about Bowtie

Online and offline, we do hear you and all the positive and negative comments left on social media and discussion forums. This is one way we learn about how you think about our products.

Sometimes, all that information means we get conflicting feedback. We want to share the underlying principle we have for our products, so that you know what guides our decisions:

Bowtie’s insurance products aim to provide a “just fit” coverage. For Bowtie VHIS Flexi Plans, we try hard to keep your out-of-pocket payments at an affordable level. Again, this means you can get private medical care treatment with a peace of mind that the money is already taken care of.

We review our coverage regularly and aim to keep the out-of-pocket expenses within HK$10,000, and so far we managed to maintain zero out-of-pocket expenses at 50th percentile. If we look at the whole medical bill, our actual average out-of-pocket was HK$3,196. We target HK$10,000 because it should be less than one month’s salary for an average person in Hong Kong, meaning most people have this amount readily available in their liquid funds. We could target a lower amount, but that would be a trade-off against higher premium inflations in the future, so we feel this is a good balance for you.

We’ll continue to use this benchmark to target benefit improvements, striking a good balance between the insurance benefits and premium costs to you.

- The above internal figures are as of January, 2022.

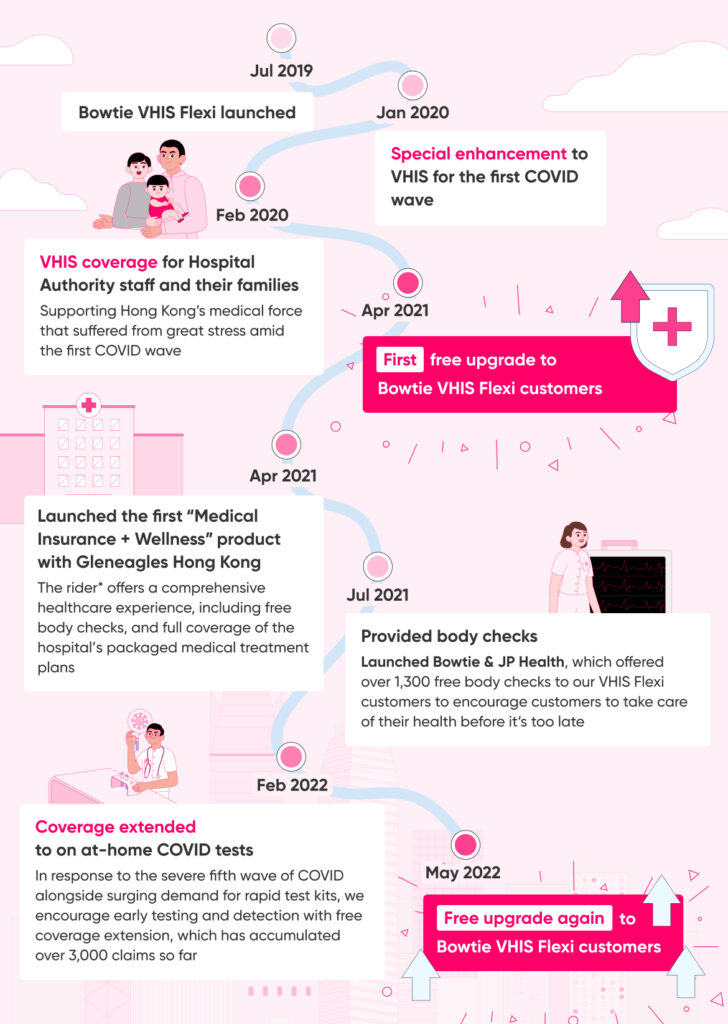

Our VHIS upgrades over three years’ time

- *Bowtie & Gleneagles Hospital Hong Kong Wellness Package is not a certified plan under VHIS.

So, no price increases this year?

Nope, no price increases this year. We try to stay humble, but we think it’s a big deal that we could offer free upgrades for the 2nd year straight. We’ve done this while offering one of the lowest cost VHIS plans in the market, and while Hong Kong’s medical inflation looks to exceed 8% this year, which is much higher than our CPI inflation (about 2%). Medical cost inflation is outside of our control, and unfortunately if it keeps increasing at these very high rates, we’ll eventually have to increase our premium rates too. So far, our technology has helped us deliver cost efficiencies, which we look to pass cost savings through to you.

For now, we’re pleased that we’ve been able to both control our premium inflation while offering benefit upgrades too, and we’ll keep working hard in this direction.

Thank you

Your support means a lot to us, and our mission is to Make Insurance Good Again. It might not be the most favorable to the traditional insurers, but there’s still a lot of work to be done with our industry.

If you have any feedback for Bowtie, we’d love to hear from you!

One more thing: get Cancer Fighter

Thank you for reading so far. Since we’re here, we’d like to put in a last reminder of our Cancer Fighter to go with your VHIS Flexi plans. We feel it’s not commonly appreciated that many medical insurance plans don’t have enough coverage for active treatments like radiotherapy and immunotherapy.

That’s why we designed Cancer Fighter to complement our VHIS Flexi plans. It’s one of the most cost-effective ways to add cancer coverage to your insurance – whether it’s our VHIS Flexi Regular and Flexi Plus plans.

Why didn’t Bowtie just package in active cancer treatment to our VHIS?

Because many people in Hong Kong already have separate cancer or critical illness coverage. Packaging it in could mean “double coverage”, and wastage, for many of our customers. We feel it’s better to give customers a choice, which is why we have this modular design. But it does mean you need to take action to pick up the modules you need! As an insurer, there’s much more that we can do to educate and recommend. This year, one of the focuses for us will be making better product recommendations, and helping customers select the most suitable portfolio answering to your unique needs.