As Bowtie strives to break through, we realized 75% of group medical claims come from standard wards1, indicating that there is a higher demand for standard wards on the market.

However, most high-end medical plans for top up provide coverage for semi-private rooms or above, creating a “coverage gap” between group medical and high-end medical plans.

Thus, working-class individuals are forced to bear the more expensive plans (semi-private ward plans are usually more expensive than ward plans). In order to provide customers one more choice for a “perfect top-up combination”, Bowtie designs the Bowtie Pink (Ward), so that everyone could have a perfect top up medical plan for their group medical insurance.

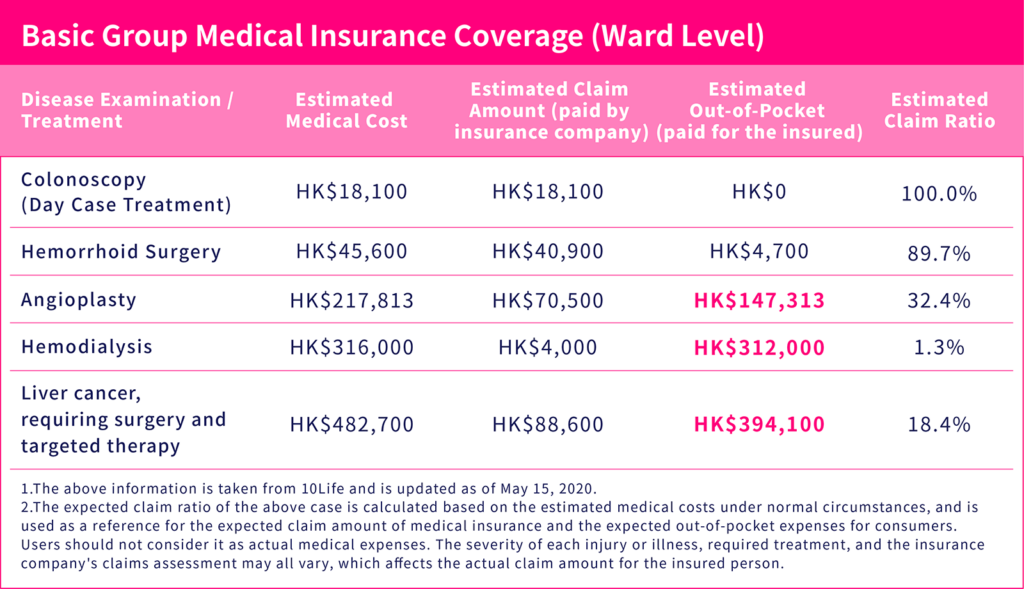

According to a research by 10Life, group medical insurance generally only provides sufficient coverage (claim ratio of > 80%) for day surgeries/check-ups or minor illnesses such as hemorrhoid surgery.

However, for major illnesses such as stroke and cancer treatment, the claim ratio is only 18.4% – 32.4%, with an out-of-pocket amount near HK$400k.

Working-class have no say on group medical coverage provided by the company. To make up for the inadequacies of their group medical insurance, they need to buy personal medical insurances themselves to top up the coverage.

Usually, to avoid overlapping insurance coverage with the group medical plan, the best approach is to purchase high-end medical insurance with a deductible.

However, there are not many high-end medical insurance plans on the market that can perfectly complement group medical insurance, especially not for the people with group medical covering only standard ward expenses.

More than 70% of hospitalization claims under group medical insurance were for standard wards1, indicating that the public’s demand for standard wards is much higher than semi-private rooms or higher-grade wards, but over 78% of the high-end VHIS plans only provide coverage for semi-private rooms or higher-grade wards2.

| Ward Level | Claim Cases | Ratio | No. of High-end VHIS covering various ward types on the market2 |

| Private | 1,756 | 4% | 8 (21.6%) |

| Semi-Private | 9,075 | 20.4% | 21 (56.8%) |

| Ward | 33,621 | 75.6% | 8 (21.6%) |

| Total | 44,452 | 100% | 37 |

When group medical insurance covers standard wards, but high-end medical insurance covers semi-private or private rooms, there will inevitably be a “coverage gap” due to the type of wards.

To help everyone better understand this “coverage gap,” we have designed a hypothetical case and explained it below.

Assuming 👨🏻Mr. Chan is protected :

If he unfortunately needs to be hospitalized for stroke treatment and receives treatment in a semi-private ward, the cost is about HK$320k.

Mr. Chan should first apply for a claim from the group medical insurance, and then the VHIS. The ideal situation is for the group medical insurance to cover the deductibles of HK$50,000, and the VHIS covers the rest of HK$270k.

💥However, this claim is not as smooth as mentioned above!

❓Reason: The group medical insurance only covers standard wards, but Mr. Chan stayed in a semi-private ward. The insurance company will add an “adjustment factor” to the claim (i.e., adjust the amount of claim), resulting in a final claim ratio of only 50%^, meaning HK$25,000.

However, Mr. Chan chose a plan with a HK$50,000 deductible, and the VHIS will only claim up to HK$270k. In such calculation, Mr. Chan must pay an out-of-pocket amount of HK$25,000. Even if he Topped Up with group medical insurance, he could not enjoy full claim.

^ Each insurance company has different practices for adjustment factors.

Note: The hypothetical case mentioned above is for reference only and is not an actual example of claim. The treatment costs and claim ratio and amount mentioned are hypothetical numbers.

| 💫Imagine if Mr. Chan had purchased a high-end VHIS with a HK$50,000 deductible and cover standard ward, and the “adjustment factor” would not be added during claim. The group medical insurance would have covered the full HK$50,000, and the VHIS would pay the remaining HK$270k. Mr. Chan would have enjoyed full claim👍🏽. |

To fill the coverage gap, a medical insurance plan that provides full coverage for standard wards is needed. Therefore, Bowtie has launched the Bowtie Pink (Ward), a “perfect Top Up insurance plan” that allows customers and most Hong Kong working-class individuals to have one more perfect plan to complement their group medical insurance and maximize the medical protection.

There are 8 similar products on the market, of which only 3 provide global coverage, and only 2 provide an annual benefit limit of HK$8 million, which is the highest on the market.

The Bowtie Pink (Ward) plan is one of them, with premiums 5-10% lower than the market average3.

To find the “perfect Top Up combination,” you need to firstly review your existing policies, understand the coverage provided by your existing group medical insurance, and then decide on the Top Up insurance.

Bowtie recommends using the “room and board” benefit amount to determine the plan and deductible best for you. By examining the “room and board” benefit amount specified in the policy, we can estimate the type of room that the plan can cover.

| Do you have Group Medical? | Group Medical room and board coverage | Deductible | Monthly Premium |

| No | N/A | $0 | $644* |

| Yes | Less than $600 | $20,000 | $321^ |

| $600 – $800 | $50,000 | $220 | |

| More than $800 | $80,000 | $197 |

| Do you have Group Medical? | Group Medical room and board coverage | Deductible | Monthly Premium |

| No | N/A | $0 | $834* |

| Yes | Less than $1,500 | $20,000 | $440^ |

| $1,500 – $1,800 | $50,000 | $335 | |

| More than $1,800 | $80,000 | $289 |

| Do you have Group Medical? | Group Medical room and board coverage | Deductible | Monthly Premium |

| No | N/A | $0 | $1,284* |

| Yes | Less than $4,300 | $20,000 | $1,042^ |

| $4,300 – $5,300 | $50,000 | $612 | |

| More than $5,300 | $80,000 | $537 |

With the other 2 Bowtie Pink plans (Semi-Private/ Private), working individuals could certainly find the perfect Top Up medical for their group medicals. If your group medical insurance covers standard ward, then choose standard ward plan; if covers semi-private, then choose semi-private ward plan, and so on.

If you are unsure about the coverage of your existing medical insurance, you can choose to purchase a plan that covers the type of ward that you prefer and select a HK$20,000 deductible, in this way, you could maintain the deductible and premium affordable.

© 2025 Bowtie Life Insurance Company Limited. All rights reserved.