High-end VHIS product Bowtie Pink introduced “Ward Room” option

Flexibly matching with group medical insurance to enjoy full reimbursement of medical expenses at excellent value

[31 July, 2023 — HONG KONG] Bowtie, Hong Kong’s first virtual insurer, has introduced the “Ward Room” option to its high-end VHIS product, Bowtie Pink. With this latest addition, Bowtie empowers its consumers to combine their personal medical insurance plans with group medical insurance plans, providing comprehensive coverage for them at excellent value.

Many individuals with group medical insurance policies are limited by the terms and conditions that restrict their choice of ward rooms in private hospitals. Based on the latest “Medical Claims Statistics” report by The Hong Kong Federation of Insurers, more than 75% of patients who opted for surgery in private hospitals and claimed reimbursement through their group medical insurance policies chose to stay in ward rooms1. In contrast, less than 4% of patients selected private rooms, while only about 20% chose semi-private rooms.

Furthermore, the data indicates that the overall reimbursement ratio for claims made in ward rooms was only 75%, suggesting that most group medical insurance plans in the market fall short of providing comprehensive medical protection for insured individuals2.

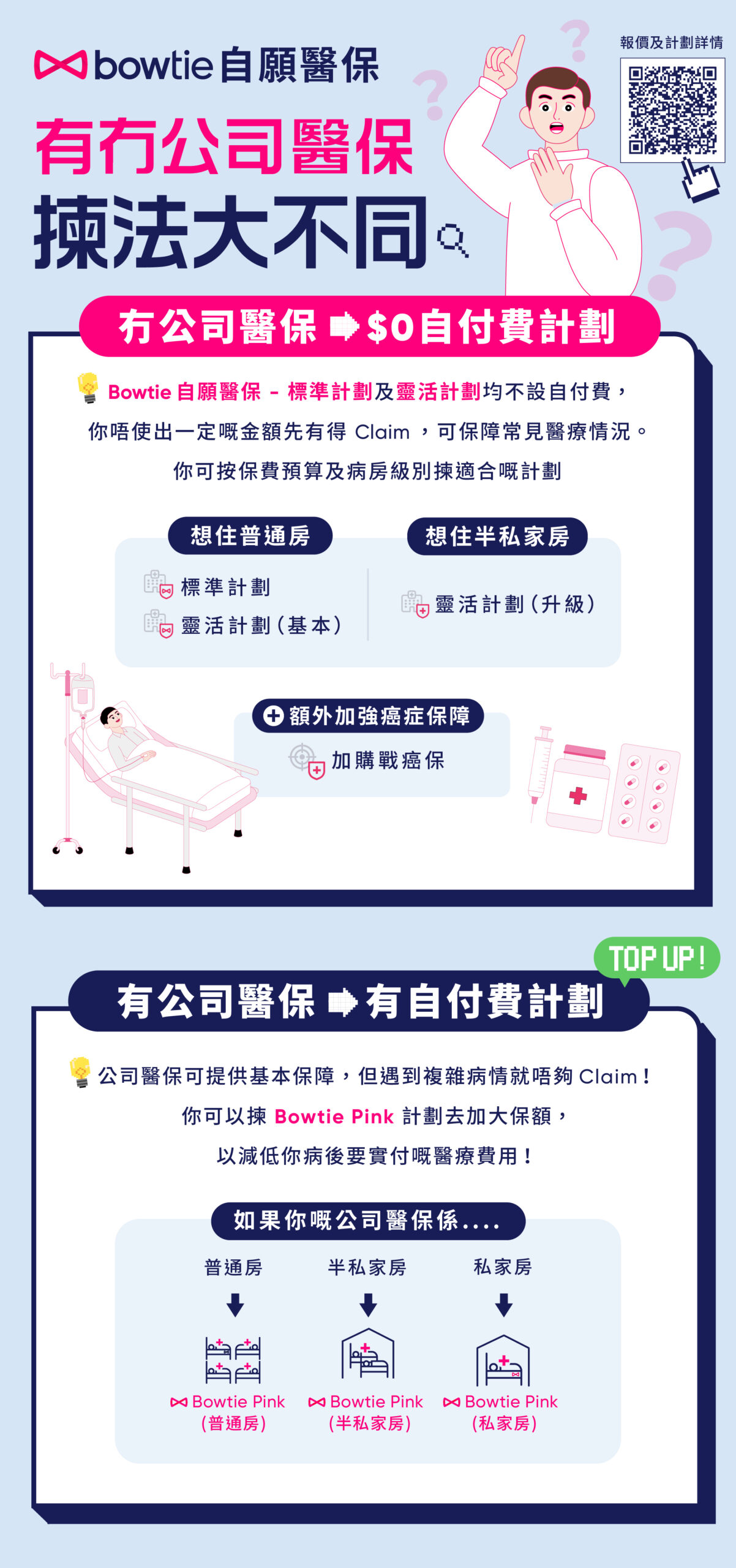

As medical expenses continue to rise, many working professionals tend to supplement their group medical insurance plans with additional medical insurance coverage. High-end medical insurance products with deductible options can be a viable solution to avoid overlapping coverage between the two separate policies, while still providing comprehensive medical protection for policyholders; with such options, they can enjoy full reimbursement of medical expenses at an affordable premium.

Bowtie Pink is currently the flagship medical insurance product of Bowtie, designed to fulfil the needs of customers seeking full reimbursement of medical expenses. The plan offers multiple deductible options as well as 2 ward options: “Semi-Private Room” and “Private Room”.

The annual limit and lifetime limit for the newly introduced “Ward Room” option are up to HK$8,000,000 and HK$40,000,000 respectively. It enables customers to choose the suitable deductible and room option based on their personal needs and existing medical protection.

Fred Ngan, Bowtie’s Co-Founder and Co-CEO said, “We have observed that numerous working professionals have limited coverage under their group medical insurance plans. As a result, we encourage them to carefully review their group medical insurance plan before purchasing any personal medical insurance products, ensuring they take full advantage of deductible options to lower premiums.”

He continued, “Since Bowtie Pink are launched, nearly 30% of VHIS customers chose this plan, reflecting the increasing confidence of consumers in the Bowtie brand; meanwhile, according to Bowtie’s claims data from the past 12 months, the reimbursement ratio for Bowtie Pink is 100%3, demonstrating our commitment to fulfilling our claim promise.”

- 1The Hong Kong Federation of Insurers: https://www.hkfi.org.hk/pdf/medical_2019.pdf (table 2.4)

- 2The Hong Kong Federation of Insurers: https://www.hkfi.org.hk/pdf/medical_2019.pdf (table 2.3)

- 3Calculation method: Amount of claims paid without ex-gratia/ amount of claims billed

About Bowtie

The Bowtie Life Insurance Company Limited is an authorised life insurance company and Hong Kong’s very first virtual insurer approved under the Fast Track pilot scheme. Through the use of modern technology and medical expertise, Bowtie offers a commission-free convenient online platform for customers to quote, apply and claim for health insurance plans certified by the Health Bureau under the Voluntary Health Insurance Scheme (VHIS). Bowtie is backed by Sun Life Financial, Mitsui & Co., Ltd and supported by leading international reinsurers. Nonetheless, Bowtie has also gone into everyday life by creating One-stop Primary Care Centre Bowtie & JP Health, Asia Health Hub Gobowtie and Bowtie Vietnam. Stay up to date at www.bowtie.com.hk.

媒體查詢:

Conrad Yeung (Bowtie)

Senior Corporate Communications Officer