Illnesses often appear suddenly and out of the blue. Some say that you only realize the importance of health when you’re without it. According to Ms. Chan, “You only realize the value of Bowtie when you’re sick.” How did Bowtie help Ms. Chan when she was ill? Let’s get to know her claim story together!

Ms. Chan (pseudonym) is insured with Bowtie VHIS – Flexi Plan (Regular) and Cancer Fighter 300. A few months after applying for insurance, she is diagnosed with breast cancer. She was completely stumped as she had never been seriously ill before. Luckily, she called Bowtie’s claims specialists, who not only answered all her questions but also helped her out all the way! Check this out!

|

|

Weighed down by both health issues and high surgery costs

In April 2020, Ms. Chan felt unwell and consulted a gynecologist, she was then referred to the surgical oncology department of Hong Kong Baptist Hospital for a PET scan examination. Later, she was referred to Hong Kong Sanatorium & Hospital for MRI and a biopsy test. After a series of tests, she was diagnosed with breast cancer in May of the same year.

Just like everybody else, she had never suffered from any serious illness. She had only visited traditional Chinese medicine once in a while to manage her health. The diagnosis caught her by surprise. When she heard the news, she felt very distressed and overwhelmed. Many questions appeared in her mind, “What treatment do I need?”, “Will it get better?”, “Are there any sequelae?”, etc. On the one hand, she was worried about her health, and on the other hand, she was concerned that the costs of surgery and chemotherapy would be too high.

Getting timely treatment, medical insurance became the strongest pillar of support

Fortunately, she was able to find silver linings in her experience of illness. In addition to the insurance she had bought, Bowtie’s claims specialists patiently answered her enquiries on the claims procedures and the estimated covered expenses., etc. What surprised her even more was a big difference that Cancer Fighter 300 had made.

Ms. Chan started the treatment immediately after the diagnosis. In half a year, she received 4 chemotherapy and 25 radiotherapy treatments. The process of each treatment was exhausting. Having to travel to and from the hospital on the same day left her with little energy to deal with much else. Fortunately, Bowtie’s claims specialists kept a close eye on her case. When she was most unwell, they went to the hospital and her home to follow up on the claims documents and care for her health, which touched her deeply.

Impressions of Bowtie

Like many Hong Kongers, Ms. Chan’s first impression of Bowtie is a virtual insurance company with Former Financial Secretary John Tsang as an adviser. Initially, she took out Bowtie’s VHIS and Cancer Fighter to get basic coverage. She was surprised to discover the true value of Bowtie when she became ill.

Claims specialists assisted in a speedy claim settlement

It was beyond Ms. Chan’s expectations that even without an agent, the service she received from Bowtie was very attentive and accommodating. Besides patiently answering all her questions, the claims specialists also reminded her of the documents needed for the hospital admission. This made the claim process effortless.

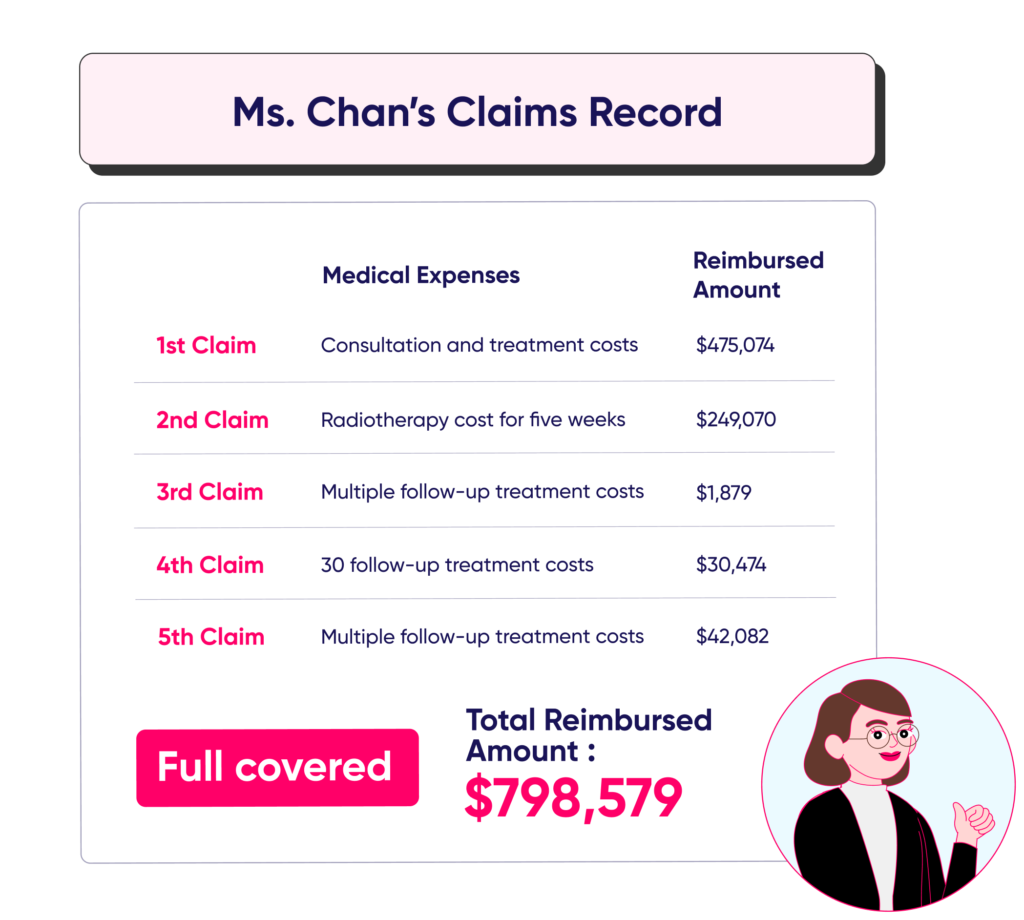

The speed of the claim settlement was also very quick. The claims specialists had kept a close eye on the case from the first diagnosis to treatment, and the settlement amount was close to HK$800,000. She thought that Bowtie’s claim process was “purely impeccable.”

Recommending Bowtie to others for better insurance protection

Under Bowtie’s protection, Ms. Chan did not have to worry about medical expenses. She could concentrate on her treatment, and now she has recovered.

Ms. Chan had introduced Bowtie to many of her friends. While many of them were skeptical at first, she managed to convince them using her own experience as evidence. She even candidly stated that very few cancer insurance plans in the market cover carcinoma in situ, and Cancer Fighter cost only HK$200-250 per month. She hopes to let her friends know how exceptional Bowtie’s service is by sharing her experience. The ultimate aim of buying insurance is to get protection. Bowtie offers both excellent service and protection!

Ms. Chan’s whole family, including her husband and 2 children, were insured by Bowtie products, including VHIS, Gleneagles Hospital Hong Kong Wellness Package, Critical Illness Insurance, Life Insurance, and Cancer Fighter. She regrets not having purchased other Bowtie products before her illness. She wishes to tell readers:

Ms. Chan claimed the above amount from Bowtie VHIS – Flexi Plan (Regular) & Cancer Fighter 300 respectively.

- The above case is an authentic account and for reference only. Actual medical expenses will depend on the doctor’s advice and decision regarding the patient’s physical condition.

We are committed to doing better and more for you. Whether it is about pre-admission compensation estimates, cashless hospitalization, or post-discharge claim procedures, we’re happy to answer your questions so that you can access timely assistance and treatment. As long as you reach out to us, we’ll answer all of your questions and help you get the highest settlement!

Learn about the claim process or get help

📞 Customer Service Hotline: 3008 8123

📞 Claim Hotline: 3001 5670

Share your thoughts with us

We care deeply about how you feel. With every advice and suggestion, we continue to learn and improve your insurance experience.

Existing Bowtie customers are welcome to leave your contact information through the link below. We will invite you to participate in interviews and tests from time to time. After the interview, we will send you a HK$100 supermarket gift voucher as a token of gratitude!