From pregnancy to the arrival of new life, and watching children grow up, each stage is full of surprises but also accompanied by different health risks and challenges.

We deeply understand the concerns and worries parents have. Even with careful preparation, thorough prenatal check-ups, following expert advice on dietary habits, and providing the best nutrition for the baby, the process is always full of unknowns. Diseases often appear when we least expect them, and congenital and hereditary diseases are particularly difficult to prevent.

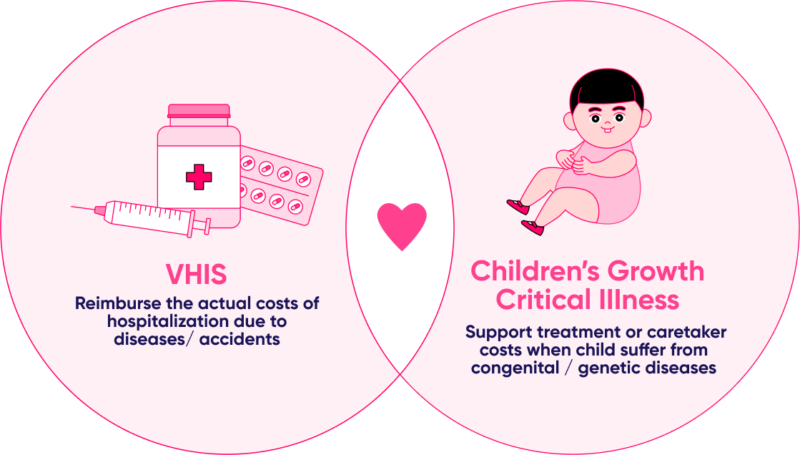

As parents, we always want to provide the best protection for our children. Although we cannot predict diseases, we can prepare in advance to ensure that even if children unfortunately fall ill, treatment won’t be delayed due to financial reasons. Unfortunately, the current insurance market offers are limited. Medical insurances don’t cover congenital diseases while VHIS don’t cover congenital diseases diagnosed before the age of 8. At the same time, critical illness insurances are often long term savings products. Moreover, the coverage offered by these plans is typically similar across the market.

Therefore, we designed the Bowtie Children’s Growth Critical Illness Protection to provide yearly renewed coverage without savings components. We aim to financially support Hong Kong parents at every stage, allowing them to focus on arranging treatment and caring for their children.

Considering that children still need protection after turning 18, we offer parents the right to convert the policy, transferring coverage to Bowtie Critical Illness without re-underwriting, ensuring continuous protection without worries2.

Like other similar insurance plans, “Bowtie Children’s Growth Critical Illness” covers pregnancy complications, congenital diseases, and neonatal conditions. Additionally, it offers a unique coverage – “Genetic Diseases”.

What are “Genetic Diseases” and why include them in the coverage?

“Genetic Diseases”, also known as “Inborn Errors of Metabolism” (IEM), though rare, can severely impact a child’s growth, development, and even lifespan. These diseases may lead to organ dysfunction and learning difficulties.

Early detection is crucial for treatment. Since 2015, Hong Kong public hospitals have been offering metabolic disease screening for newborns. However, despite the increasing prevalence of screening services, the insurance industry has not widely included “Genetic Diseases” in their coverage.

Considering the potential treatment and care costs, when developing “Bowtie Children’s Growth Critical Illness”, we included 16 “Genetic Diseases” in the coverage. These diseases have been observed in Chinese populations and usually onset before age 18. Treatment methods vary for each “Genetic Disease”; some require long-term medication, nutritional or speech therapy, while severe cases may need surgery. Our lump-sum compensation has no usage restrictions, allowing parents to flexibly address various needs.

By including “Genetic Disease” coverage, we aim to provide more comprehensive protection for children, offering financial support to parents facing these rare but profoundly impactful diseases.

Protecting “Juvenile Critical Illnesses” while also covering “Adult Critical Illnesses”

The original Bowtie Critical Illness series focuses on adult critical illness, so juvenile critical illnesses like Kawasaki disease with heart complications, juvenile Huntington’s disease, and osteogenesis imperfecta were not included.

When designing Bowtie Children’s Growth Critical Illness, we included more common childhood critical illnesses to the coverage.

Although we aim to provide protection specifically for children, and the probability of children suffering from adult critical illnesses is relatively low, we considered that many critical illnesses are trending younger. For example, stroke is generally considered a middle-aged and elderly disease, but children can also suffer strokes due to viral infections. We aim to protect against possible scenarios rather than just high-probability ones, so we’ve included the major and common “Adult Critical Illnesses” in the coverage as well, excluding some diseases like Parkinson’s and Alzheimer’s (average onset age in Hong Kong: >40 years)3,4.

Encouraging all “Bowtie Children’s Growth Critical Illness” customers to add medical insurance for the best value

To encourage parents to apply medical insurance for their children while reducing the financial pressure in the first year, we offer exclusive promotion for customers of “Bowtie Children’s Growth Critical Illness”.

Although “Bowtie Children’s Growth Critical Illness” can cover congenital, genetic diseases, and childhood critical illnesses, children more commonly encounter various minor and major illnesses after birth. Even a common fever might require hospitalization, so VHIS is essential for covering hospital expenses.

We understand that the cost of raising children is substantial, so when pricing, we specifically considered the risks at different ages (see premium table). When children are newborn or just born, their health risks are higher, so the initial premium is more expensive, with a fixed monthly rate regardless of gender.

As children grow, the chance of congenital diseases decreases, allowing room for premium adjustment. After age 1, the risk decreases, and the monthly premium becomes nearly half of the initial cost. By age 17, when the probability of illness is even lower, the monthly premium is only 12% of the premium at age 05.

The “cheaper over time” premium design is not only fair in pricing but also allows parents to save on premiums, preparing more “development funds” for their children!

© 2025 Bowtie Life Insurance Company Limited. All rights reserved.